Volatility clusters…..SP500 Volatility (VIX) and Nasdaq Volatility (VXN) remain on the wrong side of the fence line

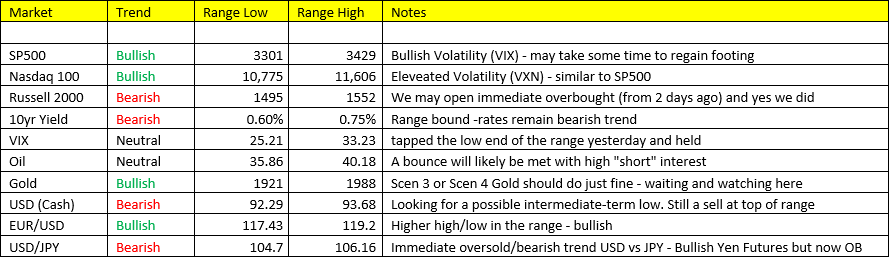

What’s the first thing you look at when you wake up in the morning and flip on the screens? Is it the DOW or worse, where TSLA is trading pre-market? Or maybe NKLA, or even SNOW now? If that’s what you’re doing, you’re doing it wrong. The Robin hoodies piled on the risk yesterday ahead of Powell and his pony show, likely selling some NKLA to buy some SNOW – which didn’t take long for you to lose 20% of your money inside of a few hours yesterday. Volatility is one of the first places I go when I wake up at 5am – or whatever ungodly time my kids decide to get up at. Somebody once said, for investors who know what they’re doing, volatility creates opportunity. Absolutely. Believe it or not, most of main street has no idea how to “trade”. And with the VIX spiking to 28.00+ and the VXN to 35.00+ that’s precisely what we did yesterday afternoon. Adding to Russell 2000 shorts on Powell, covering some Russell at the close, and riding our core positions into today. We also made it clear to our traders that raising cash in our core long Gold positions was likely a good idea as Gold signals lower highs in our range and the dollar begins to signal higher lows. Are we going to see another Scenario 4 in Q4 2020 – I can’t fully assure anybody of that, but the probability is rising. Until then we’ll do what we do, like the New England Patriots, we’ll worry about us and executing on our process and won’t worry about what’s happening in the locker room next to us.

Overnight Global Equities

USA: SP500 -1.38%, NQ -2.06%, Russell 2000 -1.20%

Europe: GER -0.65%, UK -0.35%, FRA -0.84%

Asia: Shang -0.41%, Kospi -1.21%

My 2 cents regarding the Fed Announcement- it was dovish, but the problem was and is going forward, is that the FED is now in a position where they must “outdo” themselves at every meeting. This Fed announcement wasn’t anymore dovish than the last, and left markets wanting new and fresh ideas of how they can pump up this asset bubble further. The Dollar bounced following Powell’s pow wow, whoops…rates ticked higher, albeit slightly, another whoops. So what’s the next move by the Fed? What happens if this house of cards falls again in Q4 on a return to Scenario 4 Growth/Inflation slowing, well the answer you may not like…..MMT? Negative rates? The Fed buying stocks outright? Why not, they’re already crossed that line in the corporate debt markets.

I’m going to leave it right there. A lot going on this morning.