I can’t stress the importance of U.S. dollar right here, right now. The dollar has been signaling “higher lows” in the model, which may suggest a regime change in broader asset classes. We’re coming off of a cycle in which we were BULLISH on commodity assets, BULLISH on tech, BULLISH on foreign currency, BEARISH on the USD. This could all change if the USD reverses it’s 3 month decline in Q4. Did you know….the dollar is carrying a nearly 1:1 inverse correlation to stocks and commodities. In short, Powell and Mnuchin NEED the USD down to pump asset prices. We haven’t fully pivoted to this set up yet, but some of you know that we’re slowly making that turn. If we’re moving to a Growth/Inflation slowing backdrop in Q4, we’ll be buying dollars, shorting tech (Nasdaq), and shorting commodities. What’s leading to this possible conclusion is the high sustained levels of unemployment and the eventuality that it makes its way into the commerce data, which ultimately hurts growth in Q42020 compared against Q4 2019/2018. We saw the retail sales data this week, which expressed a m/m and y/y decline – Consumer sentiment is released in about 1hr.

Global Equities:

US firm with the SP500 +0.25 and NQ +0.55%

Europe was down overnight with GER +0.10%, UK -0.42%, SPA -1.44%, FRA -0.56%

Asia, particularly China had a big night with the Shang +2.06%, and KOSPI +0.26% (we remain bullish on China as they experience Scenario 2 economically)

Volatility:

VIX and VXN remain in a “volatile state” >26.00 for the VIX and >32.00 VXN is not a friendly signal to US Equities

Commodities:

Energy- OPEC was out yesterday talking up Oil prices. Plenty of cheating/non-compliance occurred over the last few months regarding the agreed upon production cuts. In short, countries were pumping more Oil than they agreed upon. We’ve also seen strong downgrades to global demand on forward looking basis. The OPEC oil minister basically warned speculators to not bet against OPEC as they stand ready and willing to further cut production. Interesting, sounds like they may be a little paranoid of another “risk off” scenario in Q4. We may short Oil for a trade soon.

Metals- a washout in Gold and Platinum prices yesterday, we’ll continue to remain bullish of the precious metals complex FROM THE LOW END OF THEIR RESPECTIVE RANGES. There is a potential for a larger washout in prices, however.

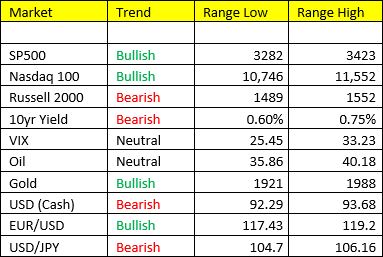

Actionable Ranges: