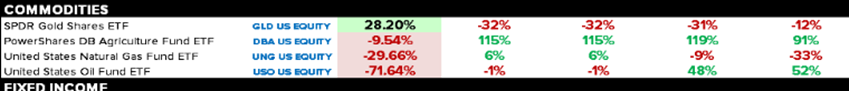

Risk assets got rocked yesterday across the board. Everything from tech names (before their end of day comeback following being immediate oversold), to Gold, to Soybeans, and on down the line. We alerted our traders of a breakout in volatility 3-4 weeks ago, and prepared. Volatility is episodic, and you must pay attention to IV on a 30 day look back. The implied volatility of Gold has also been setting off alarm bells over the past several sessions, which is why we warned our traders to take down their Gold holdings to the bare minimum. Gold IV vs 30 day realized Vol was expressing a -32% discount – which is uber complacent.

*Source: Hedgeye Risk Management

While we didn’t make a “killing” on this last episode of volatility, we did make money trading it. Our Russell 2000 and Oil shorts yielded a nice return, $900 and $1300 per contract respectively as we continue to hit at a very high batting average on the short side of the US Small Caps Index this year.

Global Equities:

The S&P 500 hit its 10% corrective mark yesterday at 3228. SP is bouncing along with Nasdaq this morning, and the Small Caps remain in the “toilet”, trading near the low end of their range.

USA: SP500 +0.18%, NQ +0.62%, RTY +0.04%

EUR: Bounce back following some hefty losses yesterday; GER +0.80%, UK +0.48%, FRA +0.28%

Asia: Shanghai -1.29%, KOSPI -2.38%

USD/Gold

Yesterday the Dollar rallied to the top of our range, and paused. Again, you can’t say that we haven’t been warning of that rising probability in our recent Market Insights letters. On the overbought signal in the Dollar yesterday, what did we do? You guessed it, we bought back into Gold on an immediate-term oversold signal. USD is now carrying a 92.59 – 93.80 range this morning, ahead of Chairman Powell’s 2 day testimony to the house financial committee.

Growth/Inflation Slowing in Q4??

Yesterday’s market action absolutely reflected the rising probability of a return this “risk off” economic backdrop in Q4. If we are indeed headed in this direction, we’d expect the likes of the USD and Gold to perform modestly well together. While the more industrialized metals will likely underperform. Long Treasuries, and Short US Small Caps (from the appropriate levels of our ranges) will also be back in our playbook. We’re living in an elevated state of volatility right now, so keep moving out there, trimming profits and replanting from better levels. Good luck.