Well, welcome to Q4 2020 I suppose….

Yesterday our Implied Vol signals were flashing -6% in the Nasdaq which put it in the 95% percentile of “complacency” on a 10yr look back. Volume also declined on yesterday’s punch higher in stocks, another signal that the “big” money had little conviction at those price points. The President contracting Covid-19 or not, we still think there was a high likely hood of waking up to a morning such as this. Copper prices fell -5.5% yesterday, along with Oil’s -3.5% plunge – two economic bellwether commodities collapsing like that intraday is usually a sign of trouble. We bought bonds yesterday, rather than shorting stocks – which was the correct call. The 10yr yield has backed off approximately 6 bps from yesterday’s open, giving us a nice bounce in the 10yr Notes. Albeit, not a good thing having the leader of the free World Covid-positive, we still think the stimulus bill is likely a more important factor for markets in the near-term. Yesterday we took our first steps in positioning for “Risk-off” in Q4 2020.

Sept Non-Farm Payrolls aka Employment Report: 661K jobs created vs 868K expected; 7.9% UE rate vs 8.2% expected

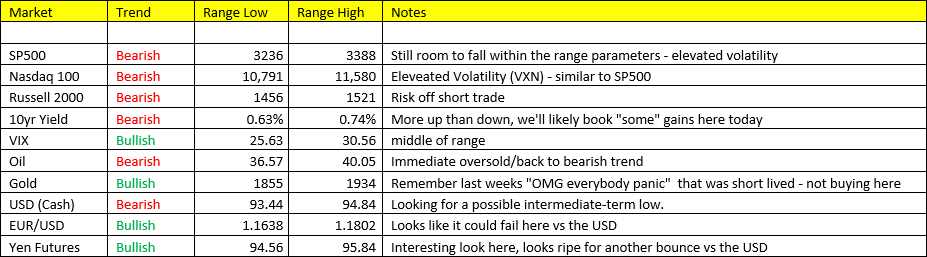

Global Equities:

USA: Sp500 -1.47%; NQ -2.08%; RTY -1.68%

EUR: GER -1.10%, UK -0.88%, FRA -0.88%

Asia: Shanghai -0.20%, KOSPI +0.86%

VIX: Signaling immediate overbought overnight to the top of the range. >10% bounce in the VIX last night.

Commodities Overnight:

Metals: Gold/Silver flat following a volatile overnight session. Gold may have some more “gas” in the tank, however we still are of the strong opinion that the US Dollar may attempt to reverse higher in the near-term providing us better entry points in Gold.

Copper: The “Dr” got trashed yesterday -5.5% signaling impending doom – and it was correct. Copper is a top long in Scenario 3, but that’s in the past now. We expect Copper to underperform going forward.

Oil– down -4.29% overnight to 37.00, now signaling immediate oversold, but flipped back to BEARISH TREND yesterday

Agriculture:

Soybeans down -0.88%

Corn down -1.18%

Coffee down -0.93%

Sugar down -1.60%

Looks like a risk off equity/commodity basket to me. Good Luck today, plenty to do. We’ll be in touch.