Just a few notes this morning,

*Stock selling has intensified a bit in the overnight SPY -0.65%, NQ -0.80%, RTY -0.80%.

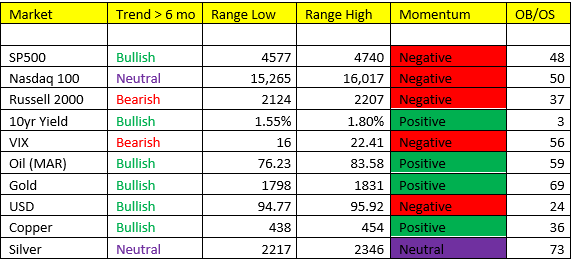

*The Russell 2000 has flipped back to bearish trend, SPY Bullish, NQ Neutral

*The USD has gained a little ground vs the euro, perhaps on a slight flight to safety bid. USD remains immediate OS vs euro here.

*Japanese yen looks like it may have secured an intermediate term “bottom” that could lift JPY/USD back to 92.00

*Yields have ticked up to 1.73%; The yield curve has flattened for the 5th straight day to 80.5bps vs 82 yesterday, and 88 on Monday

*Copper back down -2.35%

Is growth slowing front running the inflation signal? Retail sales just bombed m/m to -1.9%. We saw more hot inflation data (highly probable it slows over the next 1 to 2 months), that takes us straight into Scenario 4.

Be careful out there. Embrace the non-linearity of this market – Remember: yesterday’s market is not today’s, and these market need not follow any patterns nor ANYONE’s rules. Stay small….if you lose too much in a bad tape, you can’t participate in the good ones.