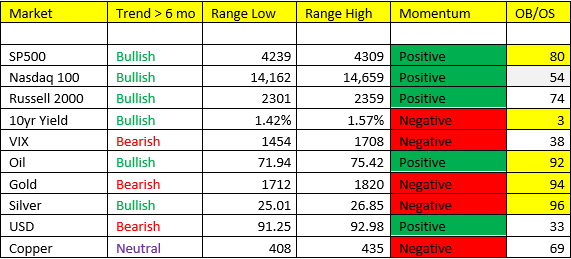

–Stocks are doing what stocks usually do into holiday weekends, expanding range on both the SPY and Nasdaq’s. Notice the NASDAQ OB/OS signal dropping to 54! Which makes it neither OB or OS but almost “Goldilocks” if you will. I recall crude oil doing something very similar just prior to its big run higher. Just an observation. Our call remains following a period of respite, stocks are likely to continue to carry higher into year-end, and we’ll likely favor the tech heavy Nasdaq.

-Crude Oil is finally triggering an immediate OB signal of 93, but remains firmly bullish trend and of course carrying positive momentum. Oil is our leading indicator for inflation

–Gold and Silver are catching bids this morning on some dollar “weakness”, but I’m skeptical of this bounce to be honest, we’ll watch from here. Gold is carrying a bearish trend, along with Negative momentum in our model.

–Copper prices are still holding negative momentum, with a neutral trend. While we think another sell-off here likely presents and optimal buying opportunity into year-end, I’d be a little more patient here. Our price range below suggests another fall off to 408.00 is probable.

US Unemployment Claims fell to at pandemic low of 364K vs 415K last week, which only solidifies our hypothesis of a strengthening jobs market.

We’ll see you back here tomorrow for the June Non-Farm Payrolls data where the market is expected to add 600K new jobs.