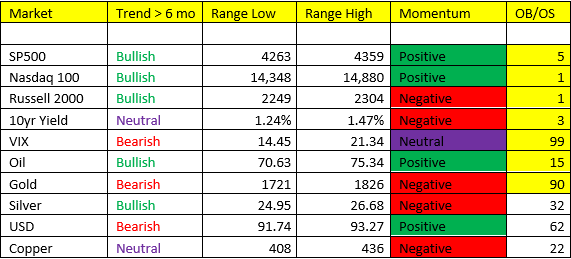

A notable development yesterday was a POSITIVE momentum shift on the WEEKLY chart in the US Dollar Index. Not a favorable development for commodity bulls in the intermediate term I’m afraid. The US dollar and bond yields have essentially been moving in the opposite direction of consensus and this coupled with the flattening of the yield curve recently, we think this is foreshadowing a period of risk off developing in macro. Furthermore, our technical view of the energy space is beginning to sour in our intermediate term outlook. Now, that doesn’t mean we won’t take a shot at a long side, likely short-dated trade in Crude Oil, as a matter of fact we’re close to pulling the trigger here. Momentum indicators remain positive in all time frames, an OS reading of 10 this morning, and we’re closing in on the low end of our range. We still think following a corrective period, energy prices could be a strong buy into year-end.

Fed Minutes and Bond Yields:

The FOMC Minutes expressed some anxieties over tapering QE purchases. The likely starting point will be pairing back their mortgage backed securities purchases in an attempt to cool off the burning hot real estate market. The next 2 Fed meetings, including the Jackson Hole Forum, will likely express a better a time line of the taper. Regarding bond yields, what I do know is this. The US Treasury is set to bring $821B new bond issuances to market in the Q3 2021 – and purchase $240B worth via QE operations. This is opposed to the $280B new bond issuances in Q2, of which the Fed subsequently purchased … $240B worth. Now, doing the first grade math, that’s going to leave a boat load of excess debt just sitting out there up for grabs … at negative real rates too mind you. I’m having a hard time fathoming there could be any sort of demand to purchase long dated debt at meager rates of return, and when adjusted for inflation – a negative rate of return. In my belief, the flood of excess debt carrying meager to negative rates of return still makes purchasing US Treasury Bonds the worst long-term investment on the board, but even still…watch out for the squeeze.

USD vs EUR Outlook:

US Dollar:

– the dollar could easily correct from here, but it’s likely a buy on the next corrective set-back.

-Momentum has now moved to positive on the weekly

-if we embark on Scenario, the USD is an overweight long position in the model.

-USD is tracking yields lower this morning, but like the falling 10yr yield – we don’t think this lasts

-The Fed is leaning Hawkish

Euro:

-the ECB went dovish (pledged more PEPP at their mid-June meeting)

-the ECB also sounds more like the Fed circa Q3/Q4 2020 – pledging to let inflation “run hot” and above their 2% target for a period of time. BEARISH EURO

-large topping formation and momentum has downshifted to NEGATIVE on the weekly

We’re in the “witching hour” of markets in my opinion. Trapped between cycles, and the current cycle is likely not going out without a fight. Earnings season is coming upon us, and we still think Scenario 2 continues to fight for more upside in equities and commodities in the near-term. Pay attention, and keep your profit and risk parameters tight – cash is not a terrible option either.