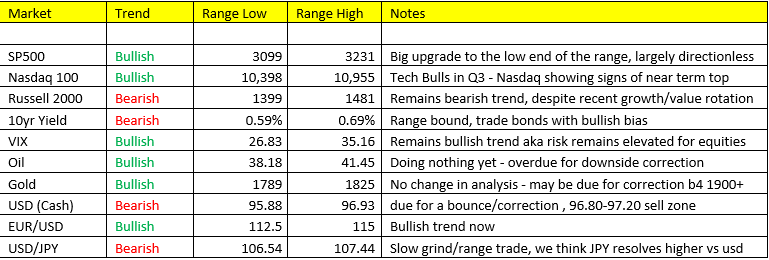

Stocks– Chopped lower mostly yesterday. China and Europe were able to eke out gains overnight on what appeared to be a rather uneventful session. We’re really in a directionless market for the past 10 days in US stocks with upside bias over the last 3 days. The VIX remains elevated and bullish trend. The VXN (Nasdaq Volatility) has also broken out to bullish trend, signaling perhaps some impending downside in the Nasdaq. Netflix missed on EPS, gained on revenue, but guided down. Microsoft earnings will be come in to focus early next week. Initials claims were +1.3M yesterday which is just mind boggling to thing how Fed liquidity has totally obfuscated the importance of employment within the economy.

Covid-19- shattered its one day record for new cases in the US at 77K on Thursday. Total cases are now 3.5M in the US. C19 hasn’t mattered to markets, in large due to well-timed/placed vaccine news, but this is clearly not getting better, which will only continue to reflect reality, and continued disconnect between the economy and markets. Put on your masks please.

Metals: Back in fill late yesterday/overnight in metals. Because many ask, I’ll tell, silver range is 1994-1867. So I’m focused on the low end of the range at the moment, even though silver has offered little in the way of any correction to buy into – but we think one may be coming soon. Gold and silver are markets we believe you just have to own at the moment for better or worse with the economic backdrop. Copper bouncing back overnight to 2.90.

Currencies- We also mentioned yesterday there’s a window where the dollar could correct some within its bearish trend, not yet however, Dollar fell back under 96.00 overnight.

The Cycle- Stagflation remains the call, for those that are new that’s Growth slowing/Inflation accelerating, or our Scenario 3 set up. Material costs continue to rise for producers, all the while the higher costs get passed on to you and I….the consumer. We see no reason to update this call here, it’s been correct all the way.