European/USA Stimulus- European officials passed a historic stimulus bill in the amount of 750B Euro, more than half of the money will be issued as grants rather than loans. Not much of a reaction in the Euro vs USD pair, likely because the U.S. is expected to pass a $1T bill this week. On that topic, all eyes will be on the House and Senate today, as there are rumors suggesting that the House (Dems controlled) and the Senate (Republican controlled) are still far apart in their negotiations. Despite the impasse, a deal is expected at some point.

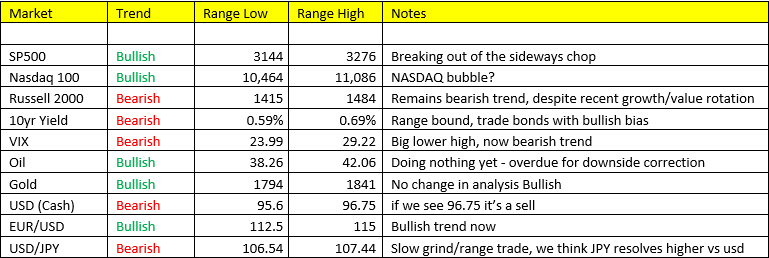

Stocks/Volatility- A breakdown in our 2 key volatility indices, the VIX and the VXN – both breaking to bearish trend. We’re agnostic about markets and recognized this possibility last week and pulled the plug on our equity shorts (the Russell). Of course this doesn’t mean we won’t signal short again, but we’ll wait and watch for now. There’s plenty of risk still out there. U.S., Europe, Asian equities all stretching higher across the board.

Metals- Rocket ship higher on the news of stimulus in both Gold, but more so Silver this morning. Silver 5.50% this morning. Copper +0.63%. All signaling immediate term overbought….but that hasn’t meant much lately. Perhaps the impasse in congress could knock these markets back some and provide some entry points.

Full steam ahead on Scenario 3 – Growth slowing/Inflation accelerating.

Feel free to reach out to John Caruso at jcaruso@rjofutures.com or 1-800-669-5354 if you’d like to get a 2 month free trial of our proprietary trade recommendations by email.

Also, be sure you sign up for our exclusive RJO Futures PRO simulated demo account here.

RJO Futures PRO Simulated Account includes:

- -$100K simulated trading capital

- -Live Streaming Quotes and Charts to help you test out your trading abilities in real-time.

- -Access to our Professional Trading Desk for advice and free daily research.