5 Stocks are all that matter……

Facebook, Apple, Amazon, Microsoft, Google have all added more than 1/3 of their market values in 2020, amid the deepest recession on record and a pandemic! While the rest of the SP500 (495 companies) are down 5% on a cap weighted basis. The SP500 is +2% on the year…..It’s truly remarkable.

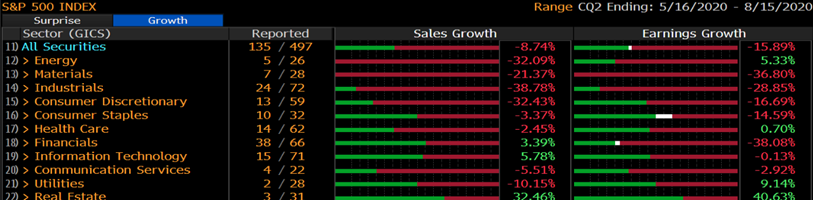

Meanwhile, aggregate earnings and sales growth of the SP500 are -15% and -8% respectively.

On that note….Congress will put on their annual dog and pony show today with Zuckerberg, Bezos, Cook, and Pichai, as if they’d even consider enforcing the Sherman Act on them.

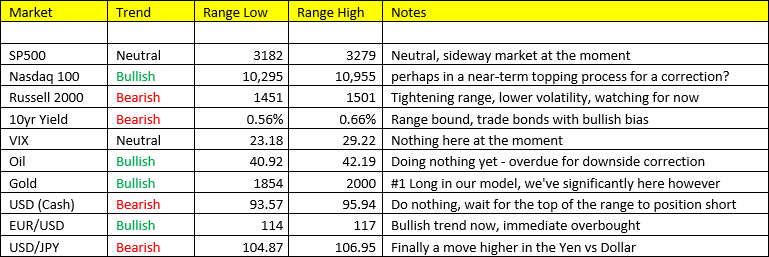

The rundown:

The Fed will announce today at 1pm CST followed by a press conference with Jerome Powell. Nothing new is expected to come of today’s meeting, but just likely more reassurance of a continued dovish policy.

Chinese equities had a big night, with Shanghai +2.06% – we’re bullish on China for likely the next 3-4 quarters. The other thing you should deem notable is that China is pausing their stimulus efforts for the time being. Citing they’d prefer not to suffer the side effects that come with increasing the debt load, and devaluing the currency. Yin vs Yang, China vs US. Xi is probably feeling pretty emboldened at the moment vs the US. I’d find some Chinese names to buy…..

Not a lot out there to discuss, we’ll try to get a Fed update out after the announcement.

Actionable Ranges: