“The pace of the recovery has slowed” – Jerome Powell

Well we heard from our most trusted UN-ELECTED official yesterday, Jerome Powell in regards to forward looking monetary policy. Powell continued to reassure the market of additional stimulus, extended lending facilities, and rock bottom interest rates for the foreseeable future. The one thing he did say that we agree with was that “the pace of the recovery has slowed” – but of course no mention of the devalued state of yours and my purchasing power via the weakened state of the U.S. dollar. From what I’ve heard directly from a former member of the Dallas Federal Reserve, that’s rule #1 of “Fed Club” – you do not speak of the U.S. dollar! Specifically when Wall Street zombie companies are being bailed out for taking on too much levered debt and now the Fed has to print and purposely devalue main street’s purchasing power. It’s rinse and repeat. I suppose we’ve learned nothing in terms of fiscal responsibility since 2008.

Stocks- U.S. stocks are indicating a negative open, and Europe and Asia traded down overnight. Q2 GDP was released while penning this letter…. -32.9% a historically negative reading. Not much reaction by markets, as this is a backward looking number and was prices in back in March and April. Big tech earnings after the bell today is what markets will be keying on – Apple, Amazon, Facebook, Google (Alphabet) – So kind of like the Superbowl of earnings.

Gold/Silver- Taking a breath today. Gold -0.63% (-$12.00) and Silver -4.00% (-$0.95). We do think there will likely be a minor pause in the rally, and yes we’re looking at rebuilding the long positions we’ve been reeling in over the past 2 weeks. If you want to chase rallies, that is your business, I will remain steadfast and patient within my process.

Agriculture- I’m getting some grief from some of you on my ag plays. Might I remind you that we haven’t really traded grains in a very long time – This is not a personal bias that I’m pressing on you, this is a favorable play in terms of what our economic cycles model is suggesting. Understandably everybody is trying jump on the gold/silver train (we’ve been long Gold since the beginning of 2019 FYI) – clearly now a consensus trade, and probably the noisiest trade since the last time it happened. Agriculture is pure play on inflation in our opinion. Might I be early? Sure that’s always a possibility, do I think I’ll be wrong? No I don’t. The patterns developing in soybeans and wheat are supportive of rally’s, and most importantly our “Stagflation” outlook for the U.S. economy going forward via the weakened state of the U.S. dollar. Regarding U.S./China relations – undoubtedly strained, however, China has made it abundantly clear that they will buy U.S. farm products when it serves them to do so and not a moment sooner or later. Did you know China imported 11mmt of Soybeans in June? They’re buying and regardless if its from the U.S. or Brazil, the global ag markets will price in the demand. There’s a lot of people that need to eat in China. Soybean prices are +6.00% since April’s crash. My immediate range in Soybeans is 877-904. A BREAKDOWN UNDER 871.50 IN NOVEMBER SOYBEANS IS WHERE I BELIEVE I’LL BE WRONG IN MY ANALYSIS.

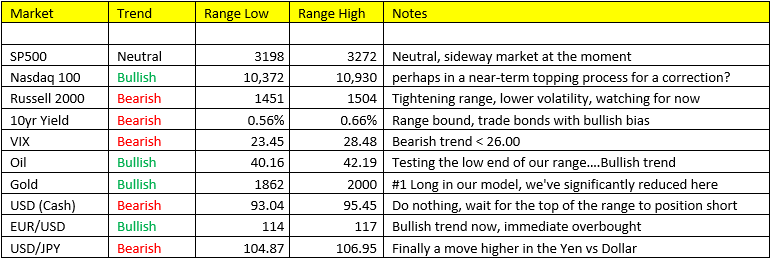

Actionable Levels

Feel free to reach out to John Caruso at jcaruso@rjofutures.com or 1-800-669-5354 if you’d like to get a 2 month free trial of our proprietary trade recommendations by email.

Also, be sure you sign up for our exclusive RJO Futures PRO simulated demo account here.

RJO Futures PRO Simulated Account includes:

- -$100K simulated trading capital

- -Live Streaming Quotes and Charts to help you test out your trading abilities in real-time.

- -Access to our Professional Trading Desk for advice and free daily research.