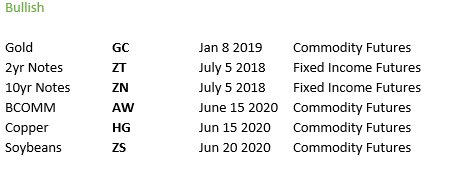

Last week we saw the 2nd consecutive uptick in unemployment claims, not to mention the 19th straight week of 1M plus claims. The employment data flat out stinks, and unless the Fed has completely been able to remove the importance of people having jobs from the economic formula, this still matters. But maybe they have, I don’t know. Regardless of what happens from here, we were correct on the inflation accelerating call – clearly reflected in our “core” long position calls of Gold, Copper, Bonds, BCOMM Index, and Soybeans.

Rundown:

Global Equities: U.S. is indicating a strong open to the week, and the Chinese Shanghai Index powered higher by 1.75%. Europe was mostly positive led by the Germans +1.70%. European PMIs last night were all back north of the benchmark “50.0” level indicating growth. The U.S. SP500 index is quickly approaching immediate-term OVERBOUGHT at the top of our range, however VIX remains bearish trend below < 26.00. Tech aka the NASDAQ is a top long in the growth and inflation model with this backdrop of inflation accelerating – NASDAQ is going to open immediate-term overbought (this is not a sell/short recommendation).

Currencies/Dollar: Catching a bid (2 days in a row WOW), +0.50%, however DOWN 6 weeks in a row or -6.7% in that time frame – Foreign currencies are naturally cooling, but setting up what we think are good buying opportunities. Stay dialed in here….

Gold/Silver– Looking for opportunities from lower levels. Action seems to be stalling in Gold around 2000 and Silver around 26.00.

The Data- as always we’re a slave to the data (maybe we should be a slave to the FED, NEVER!) – There’s evidence that the consumer slowed in July due to the increase in virus cases. We know the jobs market is still in the dumps and we’ll see more evidence on Wed, Thurs, and of course the U.S. Non-Farm Payrolls on Friday. Other areas of the data have showed improvement, but we hold the outlook that these bumps in Durable Goods, and Manufacturing data could be nothing but “bear market” bounces from the WORST data we have EVER seen in America due to the shutdown! Fitch downgraded the outlook of the U.S. debt to gdp (credit outlook) on Friday to negative – nothing to see here YET. The day they downgrade our AAA status, that might be an interesting day, but that’s for later.