NF Payrolls data:

1.8M jobs created vs 1.6M exp – Beat

10.25% rate vs 10.5% – Beat

Revisions:

May and June Payroll were revised up a net 9K

All of this was better than expected and what’s most concerning is the massive gap between the ADP data on Wed (showing 160K jobs created) vs today’s data showing 1.6M, and the potential for large revisions LOWER next month. Hmm.

Markets are chopping following the number, no real direction for the day thus far. Now the attention gets turned back to Washington DC and whether they can piece together a deal ahead of their Aug recess. I’d expect some near-term “fireworks” here as the deadline looms.

Rundown:

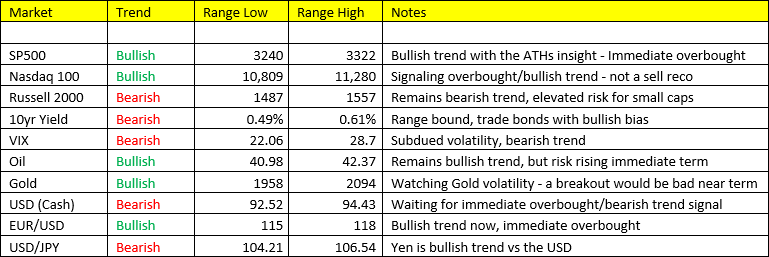

Global Equities: Europe was choppy to lower, Shanghai lost 1.00% overnight (remains bullish trend), but threatening a correction as Tencent becomes Trump’s new target. The U.S. is looking at modestly lower open. Stay bullish Tech, but bearish on Small Caps.

Bonds/Yields: despite the “better than expected” data, they can’t crack the bond market/lower yields. We’ve been in about 6-8 bps range in the 10yr for the past 2 weeks.

Gold/Silver: Following Silver’s overnight ramp to $30.00, it’s now $1.50 off the highs. We’ll wait patiently to signal here. Gold same thing, bounce overnight now backing off $27.00 off the highs.

I’m going to keep it relatively brief as we’re fairly swamped on this end. Back soon.