Will the Fed do enough this Friday at Jackson Hole? That’s the question now – will Powell be able to convince FOMC members to cut 50bps OR will the Fed continue to take their cues from lagging economic data – the cycle is slowing, and slowing at a faster rate of change now. If the Fed doesn’t pull the trigger on 50bps, we think the “risk off” trade remains in place into October. The dollar is strong, and is a quad 4 long exposure – but we do expect this top out into the Fall.

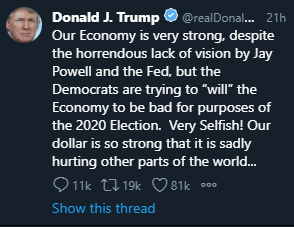

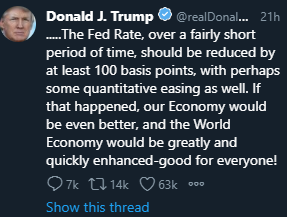

Let’s check in the President on this subject matter….

In short Trump: “The economy is strong, but need 100 bps and perhaps some QE as well”. What a time to be alive!

We sold this counter-trend bounce in the S&P 500 yesterday – in a perfect world, we’d prefer to cover ahead of the Fed, but we’ll see what develops as the week moves fwd.

Earnings- No earnings recession yet, as we had forecasted, BUT with 465/500 companies reported – we’re now at a Q2 EPS low of +1.56% with Energy, Materials, CD, CS, and Tech all down y/y.

Feel free to reach out to John Caruso at jcaruso@rjofutures.com or 1-800-669-5354 if you’d like to get a 2 month free trial of our proprietary trade recommendations by email.

Also, be sure you sign up for our exclusive RJO Futures PRO simulated demo account here.

RJO Futures PRO Simulated Account includes:

- -$100K simulated trading capital

- -Live Streaming Quotes and Charts to help you test out your trading abilities in real-time.

- -Access to our Professional Trading Desk for advice and free daily research.