Good morning,

I’m in the office this morning, so thanks for baring with me.

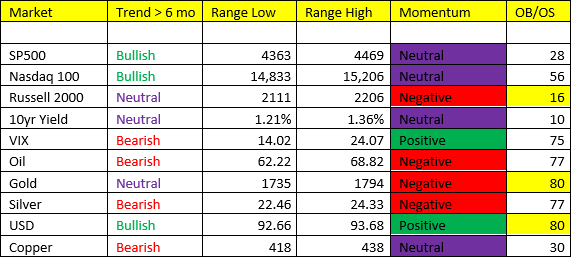

We highlighted some significant developments in our TRM table yesterday. Namely, USD transitioning to bullish trend, and key economic bellwether commodities, copper and oil flipping to bearish trend. Now, the cycle – Scenario 3 to Scenario 4 (still up for debate, but probable), and back to potentially Scenario 2/3 into yearend. So yeah, this is what we’re dealing with, a multiple personality style market. Now before you get all “beared up”, we think the probability of Scenario 4 is what we’d call “shallow”. I don’t expect anything treacherous, the Fed is watching and waiting for the appropriate time to begin the taper (which should’ve began in Q2 2021 but fairly typical they’re behind the curve). So, my point being, don’t fall in love with any particular market theme or trade. Again, today’s market is likely not going to be tomorrow’s, and all of these trends could reverse, AGAIN, within a week’s time. Tread lightly.

If you’re forcing me to look hard into the future, say over the next 12 months – it’s true, we could see a deep period of potential deleveraging/disinflation out into mid-year 2022. The year/year comps 6-12 months out are going to be nearly impossible to top vs what we just experienced in Q1/Q2 of 2021. On top of the comps, the Fed is likely to be at its most “Hawkish” point in its taper cycle…while the cycle is demonstrably SLOWING.

USD: breakout, bullish trend, immediate OB at the top of the range. This is how it could play out in the near-term: the Delta (and now Lambda) variant are a real threat – let’s say the Fed gets cold feet about the taper at Jackson Hole next week….well then we could see more pin action lower in the USD, back to BEARISH, and a resumption of the inflation trade in the NEAR-TERM. We do think that the possibility of the virus bleeding into the mid-term elections is possible/probable as we know how DC likes to play their “never let a crisis go to waste” game. The variables of what could happen from here are endless. Embrace the uncertainty.

Stocks- The IVOL premiums were huge when I looked yesterday morning, which makes us skeptical of the possibility of a “deep” correction (10% or greater). There’s too much big money betting/hedging on volatility. The NASDAQ IVOL premium is currently at 92% !! Wall Street is paying up BIG for protection, and markets don’t tend to CRASH while the market is expecting it too.

Gold- looks interesting to me here. With the flash crash of 2 weeks ago Sunday, that sent gold down nearly $100 in a blink, I think my range indicators are “off”. That was clearly a ‘false’ manipulated move, and it has thrown my range analysis off. I think so long as we hold above 1760, gold could be setting for another run towards 1820. We did see Peter Thiel in his June SEC filing reportedly purchased $50M worth of gold bars (not stocks, etfs, miners, but GOLD BARS), citing the rising probability of black swan events in the future. I don’t know what to make of this really, because $50M to a guy worth nearly $10B could simply be diversification purposes, but it’s certainly notable, but not the reason why I’m interested in gold again. With a blend of Scen. 3/4 we think gold will have its moments throughout the rest of Q3 – but choose your spots wisely. More on gold later.