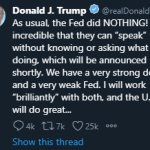

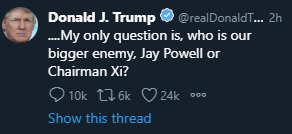

Now that Trump has labeled Xi “the enemy”, and has ORDERED ALL U.S. COMPANIES OUT OF CHINA – we’ve reached a very dangerous/heightened state in this trade war….now it’s tit for tat until somebody gets maimed. To state the obvious, Xi is president for life, Trump perhaps has 1 more year left. The heat is likely going to get turned up from here. Do you think China’s announcement of tariffs 2 hours ahead of Powell’s Jackson Hole speech was a coincidence? To be quite honest, and this may be a little bit of a “hot take”, but anything short of QE by the Fed, the market may act as if its “NOT DOVISH ENOUGH”.

Also, this last melt up in the dollar may have been all she wrote and this fits within our model suggesting inflation will reaccelerate in Q4 2019.

I’m not a foreign policy expert, far from it, and I’m very apolitical when it comes to trading, but this has gotten borderline out of control. Labeling Xi and Powell enemies is not the correct approach. And I do believe confronting China on is 100% NECESSARY for the long-term interest of the United States, but this is turning into a shit storm of epic proportions. Headed out for the weekend. Have a good one.

Feel free to reach out to John Caruso at jcaruso@rjofutures.com or 1-800-669-5354 if you’d like to get a 2 month free trial of our proprietary trade recommendations by email.

Also, be sure you sign up for our exclusive RJO Futures PRO simulated demo account here.

RJO Futures PRO Simulated Account includes:

- -$100K simulated trading capital

- -Live Streaming Quotes and Charts to help you test out your trading abilities in real-time.

- -Access to our Professional Trading Desk for advice and free daily research.