Bond yields back off, stocks bounce back, but inflation will remain our dominant theme in Q4 2021.

Now that the entire market place is stamping a 2.00% target on bond yields this morning, I won’t be surprised to see yields back off here and squeeze the CNBC headline chasers. Besides, they’re immediate OB and at the top of our range this morning – we bought back more of our existing short position (2yrs and 5yrs) over the past 1/2 days. We’ll gladly reload from better pricing.

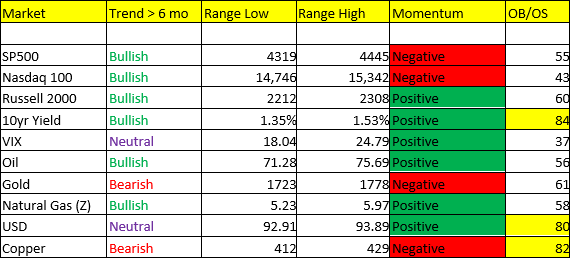

Copper fails at trend, while the dollar threatens a bullish turn – immediate range of Copper is 4.12 to 4.29 (trend), and 92.91 – 93.89 for the US dollar (at the top of the range today). For a Scenario 2 Q421, we’ll likely see copper prices move back to “Bullish” trend, and the dollar fail once again at trend – watch this dynamic. Infrastructure, Evergrande, and a US default remain the BEARISH “narratives” in the market this morning. We think its all nothing but theater, and the cycle will ultimately be the dominant factor that drives asset class performance in Q4.

Whether you want to call the current state of asset prices a “bubble” or “overvalued”, I don’t really care, those words really mean nothing to us. The cycle continues to suggest more asset price inflation is dead ahead, and believe me, when it’s time to call “BS” on market pricing, we’ll do so! Quite frankly, we can’t wait – BUT YOU DON’T BE TOO EARLY, often times the last part of the asset price inflation cycle can be the MOST VICIOUS ON THE BEARS. And the current market narratives could be setting the perfect BEAR TRAP into yearend.

Leaving it right there, my VMware is running slow at the moment so I need to get together with my IT team ahead of the open.