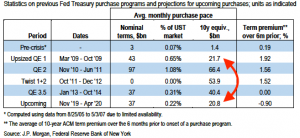

Just so you know, yesterday Fed Chairman Powell unofficially announced QE4 was happening. In the meantime, via repo facility operations, the Feds balance sheet has already expanded by $162B. Looks to be approx. 20.8B per month worth of asset purchases coming up starting in November 2019 thru April 2020.

In the event of this “unofficial” announcement of QE, Trump has elevated the trade war, blacklisting some 28 Chinese companies (largely tech companies) due to Chinese human rights violations, and now banning visas on Chinese officials linked to the mass Muslims detention facility. Still, there remains some optimism that the U.S./China can reach an interim deal – basically just kicking the can down the road on the bigger issues at hand.

We’ve been expecting this reaction by the Fed. This is likely the beginning of the Fed’s attempt to reflate asset prices via weakening the U.S. dollar. However, will the Fed be “dovish” enough remains the question. We do happen to think they’ll get it right this time – which will pull us out of the growth/inflation slowing economic back drop and into a more favorable set-up in terms of inflation (the verdict is still out on whether Growth accels or decels in Q4). Regardless, a period of “re-flation” will be bullish for commodity assets (Which is why we’ve taken a strong interest in the LONG SIDE OF ENERGY).

Data Grind (from Monday-Today)-

Japan:

Leading Economic Index – in at 91.7 down from 93.7 previously

Europe:

German Factory Orders declined to -6.7% y/y

German Industrial Production ticked higher m/m by 0.3% BUT remains -4.0% y/y

Italian Retail Sales -0.6% m/m and slipping to 0.7% y/y

US:

Producer Price Index fell by -0.3% m/m to 1.4% y/y down from 1.8%

Consumer Price Index comes out TOMORROW.

Feel free to reach out to John Caruso at jcaruso@rjofutures.com or 1-800-669-5354 if you’d like to get a 2 month free trial of our proprietary trade recommendations by email.

Also, be sure you sign up for our exclusive RJO Futures PRO simulated demo account here.

RJO Futures PRO Simulated Account includes:

- -$100K simulated trading capital

- -Live Streaming Quotes and Charts to help you test out your trading abilities in real-time.

- -Access to our Professional Trading Desk for advice and free daily research.