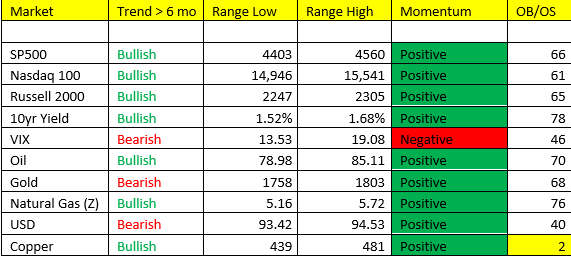

*The SP500 is pressing an ATH this morning and upside now to 4560.

*The NASDAQ has upside in the near-term to 15,541

*The Russell 2000 actually has the weakest profile at the moment, after having the strongest just a month ago during the volatility spikes in SPY and NQ – upside in the Russell 2000 to 2305, but the RVX (Russ Vol) still suggesting even more room on the downside to 18.66.

Your tell-tale sign has been the 10-yr yield breaking out of its lethargic 1.20-1.30 range at the end of September to tack on 40bps in a mere 30 day period.

The GDP and Inflation model we track has Q4 GDP estimated at 6.42% q/q, and 5.84% y/y (last updated on Monday). Headline inflation for Q4 6.42% q/q and 5.84% y/y, Headline inflation 5.37% – and if you think these estimates are HIGH, the market isn’t suggesting so this morning.

Lastly, IVOL discounts are growing day/day and week/week – this is telling you that Wall Street is getting LONGER.

Also, Gold – we’re getting ready to move on this again.