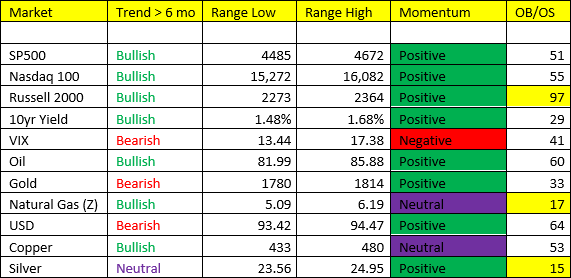

A massive rally yesterday in US Value with the Russell 2000 gaining +2.3%. Now signaling immediate OB, but on the brink of eclipsing a new ATH. We did catch it with some of our core longs, but it’s my fault we didn’t catch it “bigger”. We’ll likely have another look in coming weeks we think from more favorable levels – or maybe not, we’ll see. The SP500 also closed at a new ATH which I believe is its 60th All-time CLOSING High of the year. Earnings remain solid, despite the disappointments from Apple, Facebook, and Amazon. Aggregate SPY Sales growth +17.69%, and EPS growth +38% with more than half of the Index having reported.

*ISM MFG PMI slowed yesterday m/m but rose y/y to 60.8.

Today marks the beginning of the FOMCs 2 day policy meeting. I think by now we all know what’s coming, and to be honest, it’s overdue and much ado about nothing if you ask me.

*Copper catching a slight bid here, with the LME stocks reporting another decline in inventories.

*Oil- can’t stop, won’t stop. Lower high in the range, could mean a quick but shallow correction, but you certainly don’t play for one. Path of least resistance remains UP, and every break in the market has been a buying opportunity.

*USD/Gold – just a lot of chop in these 2 markets with no real sense of direction. I will certainly welcome another SELL opportunity in Gold if presented with one. Gold doesn’t look to be ready to move into a favorable period until out into next year/and may likely coincide with a cool down period in US Rates/a stronger USD as we head into very difficult y/y comparisons for macro data and corporate earnings in Q2/Q3 2022.