Peak inflation or modest correction? Or both?

It’s a very plausible question to be asking yourself right now. We’re seeing some materially negative near-term breakdowns in some key economic/inflation sensitive markets:

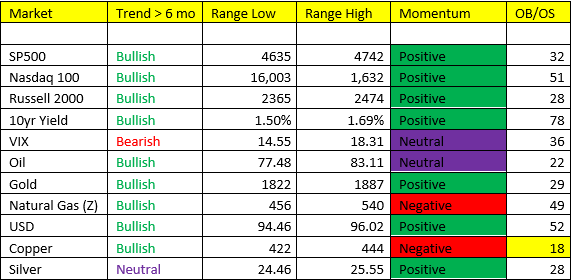

Copper (-4.9% this week and -12% from its peak),

Oil (-10.4% from its peak),

Natural Gas (-26% from its October peak).

With the raging hot inflation and retail sales data, +6.2% and +1.7% over the last 10 days, what gives? Well, for one thing the Growth/Inflation accelerating call (that we’ve been long of since the middle of October) has now officially gone MAINSTREAM. It’s no longer a mystery for people who don’t have a process for making such predictive calls, all you need now is a Wall Street Journal. So there’s the old, buy the rumor sell the fact style trade happening at the moment.

These corrections we’re seeing in oil, copper, and natural gas will eventually bottom and begin to reflate into yearend. They all remain BULLISH trend. Whether we achieve new highs is very questionable at this point, and likely depends on whether we’ve just seen the “as hot as it gets” reading on headline inflation. The Fed remains in a “dovish” posture with regards to monetary policy (despite the taper), and I’m still BULLISH COMMODITIES likely into yearend.

Oil: a bullish draw in inventories yesterday, and supply/demand fundamentals remain tight out into 2022. A rumor of an SPR tap by the US and China overshadowed yesterday’s inventory draw. I’d love to buy that dip if they release reserves into the market – this has never permanently solved a supply/demand imbalance in crude in the past.

Bond Yields: now that it’s a “known” to the market the Growth/Inflation is accelerating in Q4…CTAs and managed funds beefed up there bond short position over the past 2 weeks, and rightfully so. UST’s are easily one of, if not the worst investments in the market. But the hefty short position is ripe to be squeezed higher in coming weeks. When the Fed actually has to pivot to a more hawkish stance on taper and policy (which we think is sometime early next year), beware for a fast move in the bond/interest rates market. For now, we’ve shored up the majority of our bond shorts, but still keeping a small core short – which we’ll gladly add to from the bottom of the range in bond yields.