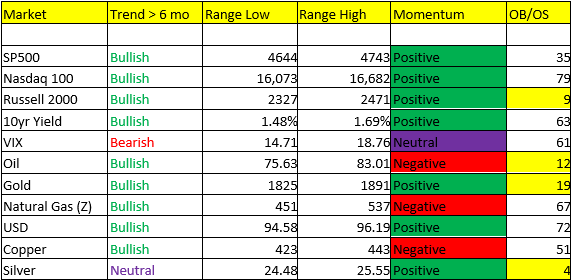

Bond shorts are getting “hugged” this morning. We’ve mentioned the massive short position in the bond market as of the latest CFTC position report (nearly 100% of CTAs are short according to some sources). So you get a net consensus position and BAM! Bond yields are back down 10 bps from the recent high of 1.64%. This won’t last, but it could carry on for a few more sessions – remember, it’s widely recognized that being long on US treasuries is one of the worst places you could be invested. When adjusted for inflation, real rates on the 10yr are NEGATIVE. We’ve been busy covering the bulk of our short position over the past week, but still leaving a core short (which we’ll be grossing up from the low end of the 10yr yield range of 1.48%).

Stocks: the NASDAQ 100 Index closed at another ATH on the year yesterday (16,508) and is etching out new ATHs once again this morning. The small cap Russell 2000 isn’t fairing as well this morning (-1.42%), which is likely due to the slide in bond yields and energy (remember 26% of the RTY consists of Financial stocks). I’m not concerned with this slide, because we’ll likely see that rotation BACK into small caps over the next 1 or 2 weeks. We’ve signaled 4 times to buy the Indices this year, and have hit on all 4. We’ll wait on watch a little before we look at perhaps grossing up the small caps.

Oil- Another deep dive overnight. I’m hearing certain parts of Europe are locking down again, as well as Australia. I haven’t heard anything further on SPR releases from the US and China, besides, in the past those have been buying opportunities. Those reserves eventually need to be refilled. Oil is immediate OS right here right now, low end of the range, and BULLISH TREND remains intact.

Bitcoin- I’ve been thinking about re-adding the bitcoin range back into our table below. BTC remains BULLISH TREND, Neutral Momentum, and immediately OS right here right now. I’ve been lightly buying over the past few days in BTC and ETH.

Lastly, every and any negative headline on Covid-19 has been a buying opportunity for the past 1.5yr. I don’t suspect this time is any different.