“You become a winner when you lose. Everyone plays well when they’re winning. But can you control yourself and play well when you’re losing…..remaining objective as to what your chances are in the hand. If you can do that, then you’ve conquered the game” – Dan Harrington

Good morning,

Can you handle defeat? Can you maintain your “cool” in times of stress, does your decision making process remain resolute? Again, the above quote is from the “The Biggest Bluff”. There’s an old Rudyard Kipling poem entitled “If” that probably sums this up best. I’d encourage you to check it out.

Review:

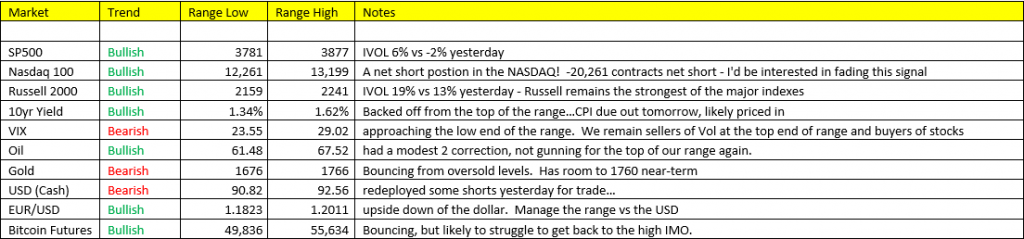

Stocks- Bounce. Wash DC Stimulus efforts look to be nearly complete. NASDAQ remains in the “red” ytd -2.3%, as the re-open stocks gain aka the small caps gain capture the rotation in markets. Basically, what worked during the pandemic (the stay-at-home stocks) is no longer “Alpha”. On top of this, the NASDAQ is now carrying a net short position according to CFTC Futs/Opts positioning. This could be an interesting signal to “fade”.

Bonds- The 10yr yield is backing off from an immediate OS level this morning. 1.53% last tick, we’d welcome 1.37% as “trading opportunity” on the short side of Bonds. Tomorrow’s CPI data is likely baked into markets, which should undoubtedly show an acceleration in headline consumer inflation.

Commodities:

*Gold catches a bid +1.70%, as the dollar slides overnight. Remember, gold remains bearish trend, and until it recaptures its 3-6 month bullish trend OR finds itself within a more favorable economic backdrop, we’ll remain sellers of gold – with that said, gold has room to run within our risk parameters, 1766 is the high end in our range parameters.

*Silver, also bid this morning, staving off a trend breakdown over the past few sessions. Silver is NOT gold, and looks nothing like gold on the charts – therefore we can remain near-term favorable on silver over gold.

*Oil – remains bullish trend, and we’d welcome a long sided trade from the low end of our range. A lot of “$100 bbl” talk circulating in the inner Wall Street circles.

Good luck to ya!