More Growth/Inflation accelerating style markets this morning….SPY +0.68%, NQ +0.76%, and that damn Russell 2000 aka the “reopening stocks” leading the charge +1.12%. Later today Janet Yellen will testify in front of the Senate Finance Committee, and in her prepared remarks claims that it’s time to “GO BIG” on deficit spending! I fully expect this to be the game plan going forward, as this new crop of finance leaders are all subscriber’s to modern monetary theory. If you don’t believe me, read the “The Deficit Myth” by Stephanie Kelton – In short, the theory is if the Government runs $100 deficit, taxes away $99 = a net surplus of $1 to the private sector – Surpluses bad, Deficits good so long as you have currency sovereignty, aka the ability to hit the Ctrl + Alt + Print button on our computer’s. That’s the game plan in a nutshell, I’d encourage you to check it out to gain a better understanding of what’s likely coming down the road.

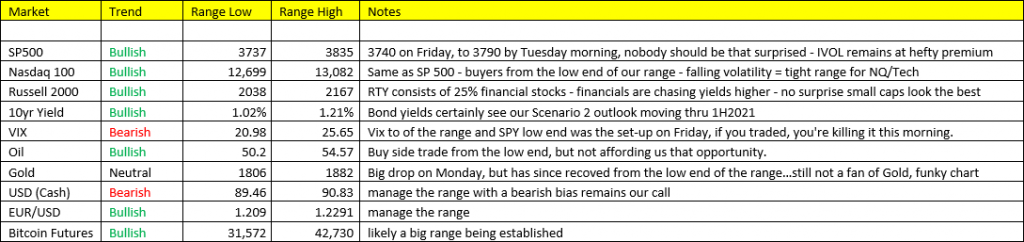

Stocks- Massive implied vol premiums on Friday…aka the street is protected for downside, they’re expecting it actually – which is why they may not be getting it!! Premiums exploded in the final week of 2020, and have remained very “fearful” ever since. We remain bullish until the Scenario changes/and OR our quantitative signal changes. Sure, there’s plenty of narratives to be bearish this market, but quite frankly, none of them matter so long as the cycle remains Scenario 2. Q4 2020 earnings season kicks off this week.

Yields- 10yr yield back to 1.11% this morning, with immediate upside to 1.21% and downside to 1.02% – smack in the middle of the range. We’re holding our core shorts in the 10yr’s and Eurodollar positions, and will welcome the opportunity to ADD to those positions from the low end of the range in bond yields.

Good luck today,