This is a little bit of a shock…March CPI 1.4% y/y vs 1.5% and +0.3 vs +0.4 m/m – interesting, and likely an outlier in terms of inflation expectations actually going DOWN. Insert the *skeptical face with monocle* emoji. This is fake news ladies and gentleman. The accelerated moves in commodities particularly over the past 3-4 months does not line up with the reported data. Hmm. I’m going to have to do a deeper dive on this data point. All in all this is a good thing…if they want to drive yields lower/bonds higher again, we’ll sell right into them!

Stocks clawing to new ATHs overnight, and still punching higher pre-market. IVOLs are definitely coming in

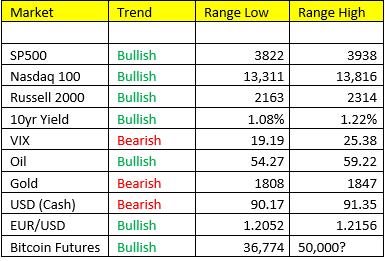

10yr yields @ 1.15% with immediate upside to 1.22% and 1.08% – no change on our call here, as a matter of fact, bonds may be giving us another opportunity to re-gross our position UP to full size in coming day’s/weeks.

Metals- particularly Platinum +5.64% overnight to a new multi-year high of 1263 oz! Gold +1.0%, Copper +1.88%, Silver +0.56%

Fed Chair Powell speaks today at 2pm EST