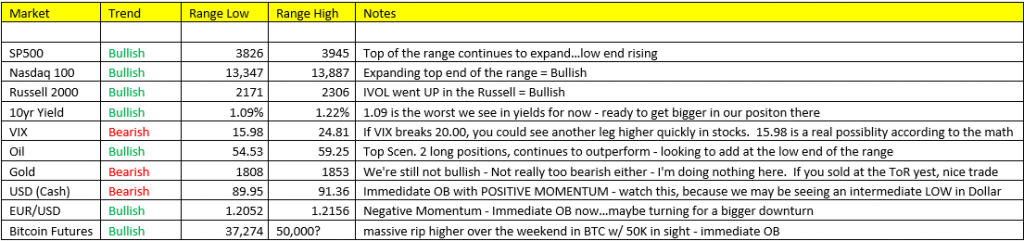

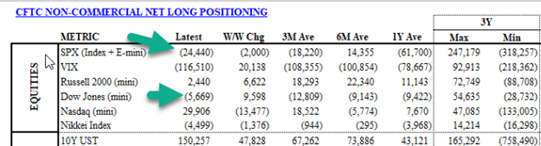

SP500- interesting tidbit for you on the SPY CFTC positioning – headed into the end of Q3 2018 AKA the peak of the growth cycle, the SPY was carrying a NET LONG position of 247K contracts…today it’s carrying a NET SHORT position of 24K contracts. Think about that. What this tells me is that consensus is nowhere near BUBBLE territory in terms of exuberance and net positioning. Interesting. EPS and Sales Rev’s continue to post strong results as well. BONUS: the lower range of the VIX has just puked to 15.98! 15.98 VIX is a possibility.

Yields- While talking heads on TV like to compare present market climate to those of the past, we always hear of the dot com bubble at the end of the 1990s/early 2000s. The interesting comparison is more to do with the yield environments between present day and 1999 – when the 10yr was yielding 6% vs today 1.14% – low rates, Fed monetary and FISCAL support….again to me, we may have a lot more to go in terms of stock market exuberance – and certainly PLENTY of more room to run in 10yr yields!