“One thing I’ve learned in 29yrs of playing tennis: Life will throw everything but the kitchen sink in your path, and then it will throw the kitchen sink. It’s your job to avoid the obstacles. If you let them stop you or distract you, you’re not doing your job, and failing to do your job will cause regrets that paralyze you more than a bad back” – Andre Agassi “Open”

Good morning,

The above quote is from Andre Agassi’s autobiography OPEN. Not sure why I decided to pick this book up, perhaps I needed a break from the finance and political drivel I’ve been reading. But I am enjoying it. As a former athlete myself, I find many parallels on a day to day basis between markets and sports. I’m not big on sports analogies, so I’ll save you those, but we’re all stricken with adversity in all aspects of our lives, and often time in markets. Focus, stay disciplined, let the bad day’s go (because they are inevitable), learn from them, and most of all stay process driven.

I’m going to keep it brief this morning, believe it or not I had a very pressing issue that needed to be taken care of at 6am this morning so I’m playing from behind schedule.

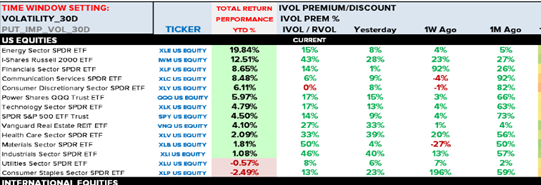

IVOL remains at a PREMIUM – check out the Russell 2000 ETF at 43% +20% from last week!

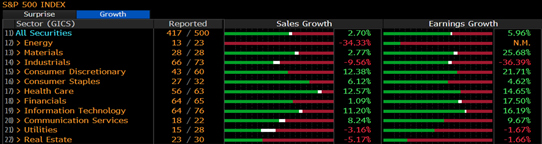

Earnings remain strong headed into the tail end.

Good Luck!