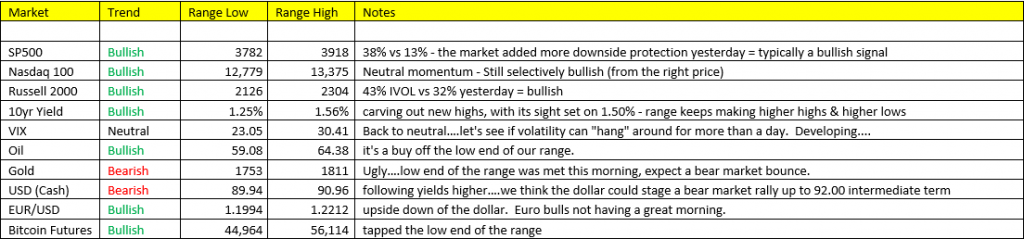

Risk happens slowly, and then all at once. This was certainly the case in the bond/interest rates market yesterday. The 10yr yield crept higher overnight to 1.48%, eclipsed the 1.50% mark late morning, and then spiked to 1.61%, wreaking havoc on the bond market, and simultaneously spooking the stock market. Perhaps the most significant development was the 10yr benchmark yield eclipsing the S&P 500 dividend yield. Why? In short, it’s a signal of direct competition to the stock market. It’s a wake-up call to investors that stocks may no longer be the only game in town to capture yield going forward. Believe it or not, there’s plenty of institutional investors/pensions in this world that would be ok with parking a portion of their liquid capital in government bonds at 1.50% vs having to be “all in” on higher risk investments aka stocks to capture yield. But, 1.50% is still a paltry return, and also arguably adjusted for inflation and devalued dollars over a 10yr horizon may be ultimately be a poor investment, which is still a reason we like the short side in bonds (and long side of stocks) and think debt market investors will continue to demand higher yields based upon inflation aka higher commodity price expectations. Congratulations for those that were on board with this market call with us since Nov/Dec. And it’s likely not over yet. Sharpen your knives because we’ll be back in on the short side of bonds headed into headline CPI in 2 weeks.

Stocks– we’re still hunting for long side entries. We’re not even remotely close to positioning for what we think may be coming in the back half of this year, so let’s just put those questions to rest. I have no fundamental nor quantitative reason go there yet. Believe me, I love shorting stocks, and you’ll be the first to know when we make that leap. For now, Growth/Inflation accelerating, and strong earnings accelerations through Q2 remains our call….long stocks, short bonds, long commodities. Remember, we’re comparing y/y to the government shutdown in Q2 2020. Value stocks will likely continue to outperform, as they were the most affected by the pandemic and shutdown whereas tech was largely considered the “Stay at Home” stocks, and will have a difficult time (dare I say impossible time) beating y/y growth expectations in EPS and Profits – hence the flatlining/weakening chart structures of AAPL and AMZN. Hope that makes sense. Wall st is or at least should be chasing the high beta garbage small cap stocks…I mean honestly how much longer can they get away with charging 2% and 20% to buy and hold FAANG stocks? Anybody can do that, and most do.

Dollar– bounce…we’ve been expecting one. The dollar is going to move from immediate OS yesterday at the low end of the range, to close to immediate OB. Dollar likes “up rates” and “down stocks” and that’s precisely the formula we have this morning. We’re still largely dollar bears, so we’ll hunt for short opportunities here in coming days/weeks. Dollar remains bearish trend, and bearish in our model in Scenario 2.

The Fed’s favorite inflation indicator = PCE Index +1.5% vs 1.4% y/y