Following a bounce to “lower highs” overnight in stocks, we’re right back down where we closed yesterday. US ADP Employment was released this morning printing 117K vs 200K exp private payrolls released. I’d say at the moment, I’m “renting” a short side view – we’re still bullish on the cycle, but have recognized that some of our tools are reading immediate OB. Bull market’s correct on the downside, bear markets correct on the upside, but the cycle ultimately leads the way for extended periods. There’s a brief period of about 1.5 weeks for us to correct, but we ultimately will likely buy that correction in month end/quarter end.

One of our indicators flashing “caution” for the bulls yesterday was the decrease in the IVOL premiums day/day and week/week.

Current IVOL set-up:

SPY 2% vs -2% yesterday vs 24% last week (a 22% decrease from last week)

NQ 9% vs 4% yesterday vs 36% last week

RTY 23% vs 14% yesterday vs 42% last week

-if you need further explanation of how we use IVOL for sentiment, please reach out directly.

*Yields, back up. 1.47% in the 10yr yield, with immediate upside to 1.55%.

*Dollar reversed the reverse this morning, likely trading alongside rates. Back hovering around 91.00. We remains bearish on the USD for the moment.

*Metals back down this morning, with the reversal higher in the Dollar.

Not too much more to discuss other than waiting for Friday’s Non-Farm Payrolls data, and then of course headline CPI next Tuesday.

Good luck out there,

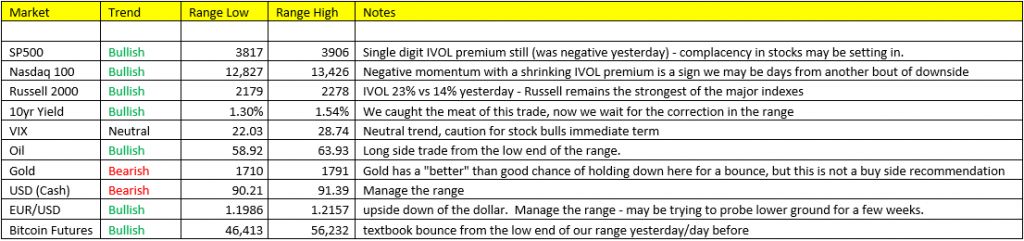

Today’s Ranges: