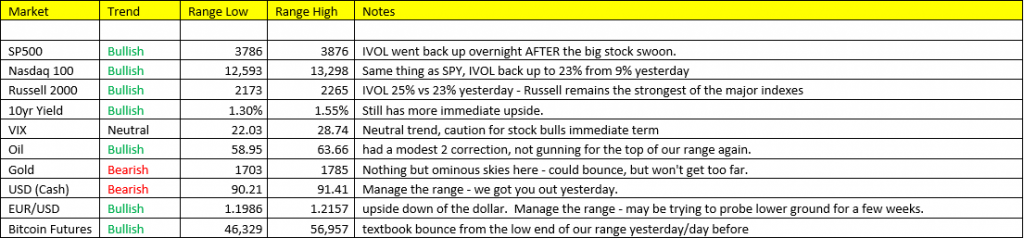

Volatility – while vol tends to sneak up on most, I can’t say that we weren’t ready for it. Recognizing some key players in the FAANG stocks breaking down over the last week, AND the drastic w/w change in our IVOL signal, I actually rented a modest short position over the past few days in “growth” aka NASDAQ. As I mentioned yesterday’s letter, we remain bullish on the cycle, but with the VIX and VXN (NQ volatility) breaking to bullish trend in the last 24hrs, I need to stop and respect that signal. Whether we hold bullish trend for more than a day remains to be seen (I don’t think it will). Keep an eye out…the Russell 2000 has me interested, but wait for me on this.

Commodities- Buying/trading opportunities lay ahead.

*We’re housing some Silver on our books that’s moved against us for a couple of days, but honestly, I see no imminent signs of trouble here. Silver remains bullish in the model, and more importantly, bullish trend. If we see a trend breakdown here, we’ll respect that bull to bear phase transition and exit with no questions asked.

*Copper and Platinum are both correcting, very intriguing dips to look at buying here.

*Oil/Energy – no dip here. Despite the massive build in inventories of CL yesterday, we’re +5.00% over the past 2 days.

China Stagflation? Something to consider in regards to commodities, is China looks to be moving into a Scenario 3 set-up. They are likely to begin to see some ‘stagnation’ in growth. Of course China is the worlds largest consumer of commodities globally. This is something we’re monitoring closely, Shanghai -2.05% breaking trend last night.