“My reasons for getting into poker in the first place were to better understand that line between skill and luck, to learn what I could control and what I couldn’t, and here was a strongly-worded lesson if ever there were: you can’t bluff chance. I could plan all I wanted, but the X-factor could still always get me. The outcome would be what it would be. All I could do was my best with what I could control – and the rest, well, the rest wasn’t up to me” – Maria Konnikova

Good Morning,

The above quote is from Maria Konnikova’s newest book “The Biggest Bluff” – which I can already tell is going to be one of my all-time favorite books that pertains to behavioral psychology. I’ve mentioned recently that the game is going to get harder from here. Don’t confuse a bull market with genius…is a saying I often heard echoed during my days at the CBOT. And it’s true. Market conditions have afforded us a nice run over the past several months, but it just got a little harder last week with the unexpected squall of volatility. The only real question is how do you approach the current market environment? With fear or opportunity? We’re going to keep doing what we’re doing, because much like the game of poker, if you have good process for making decisions in the market, you should be able to put yourself in higher probability situations that help you win over time. Chance is always in the backdrop of almost anything you do in life, “you can’t bluff chance”. We’ll control what we can and chalk-up what we can’t.

Last week in review:

Stocks:

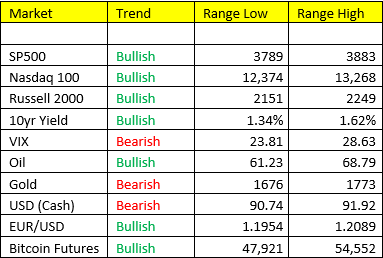

SP500 finished +0.6% for the week – but not after suffering a 6% correction from the ATH down to 3720. Is that it? Well I don’t know the answer to that, but I’d bank on some more near-term volatility as we kick off the week. Remains Bullish trend

NASDAQ -2.3% for the week, and extended its correction from peak to trough to approximately -12.2% before staging a late Friday recovery rally. Bullish trend in tact

Russell 2000 finished down -0.6% for the week. -10% correction from peak to trough over the past 4 weeks. Bullish trend

Commodities:

Oil- +6.9%; No correction in the oil patch and remains firmly Bullish trend, but now immediate OB

Nat Gas: -3.3% for the week. Interesting look in Nat Gas, remains bullish trend, one of our tech strategist’s likes it moving higher in weeks to come, and fits our Scenario 2 model for Q1/Q2…this could be one we signal this week on the long side.

Silver -5.2%, awful week for silver and early Friday began toying with a trend reversal (24.76 flips it to bearish)

Copper UNCH on the week, we had a correction to buy into, it happened fast.

Currencies:

Dollar Index +1.3%, which is a substantial sized move for a currency inside of a week. Will it hold from here is the question, I’ve my doubts in the immediate term. But as we’ve also warned, the US economy is likely staring at Scenario 4 come Q3 2021 – and this may be part of a near-term bottoming process preparing for that outlook. We’re still sellers of the USD a the top of our range. Q3 is still a long way’s off!

Japanese Yen -1.6% by far the biggest loser was the JPY/USD currency cross.

Gold -1.9% last week, and taking its 3 week slide to -7%.

Treasuries:

10yr yield’s gained +6.8% last week, finishing up at 1.55% – Bullish trend;

Fed Policy – Now the question we’re asking ourselves is what’s the Fed’s next move in-terms of implementing an “operation twist/yield curve control” policy? For one thing, I believe the equity picture has to grow much more grim for something of that effect to go into place. A 6% and 12% correction in SPY and Nasdaq doesn’t quite constitute a more dovish policy stance quite yet, never mind the current accelerated pace of growth and inflation in Q1 2021. We’re very interested in hearing out Jay Powell at his next FOMC gathering next week (March 17) – and think it’s likely they save their monetary and fiscal bullets for another time.