“Where observation is concerned, chance favors the prepared mind.” -Louis Pasteur

Good morning,

Pay attention, and you’ll be able to mitigate chance when it crosses life’s path, is how I’d translate the above quote which of course I came across in Konnikova’s “The Biggest Bluff”. I also remember a quote from legendary golfer Gary Player that is very apropos….”The more I practice, the luckier I get”. Cool.

Surveying the market landscape this morning…

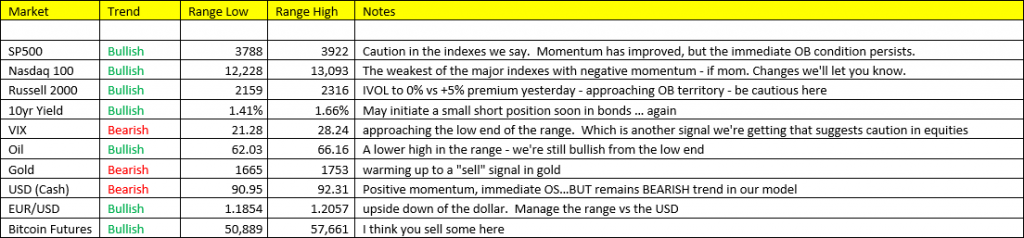

Stocks are jamming again on the upside – some follow thru on the stimulus party that started Tuesday. The momentum conditions in the SPY has improved, however now carrying an implied vol vs 30 day realized vol DISCOUNT which is a contrarian signal. The Nasdaq however is a different story, still Negative momentum and signaling immediate OB this morning.

Yields – backing off to 1.50% in the 10yr, throwing bonds into an immediate OB position with negative momentum – we’re not quite at the low end of our range however which is closer to 1.41% this morning. I could begin to layer into the bond market soon (bearish of course).

ECB – released there monetary policy plan this morning, of course leaving the overnight lending rates at 0.00%, and promised to step up their PEPP purchases in months to come (European QE). This is really not new news – this has widely been expected in recent weeks, hence the drop in the EUR/USD leading up to the meeting.