Good morning,

2 important macro shifts I’m seeing this morning:

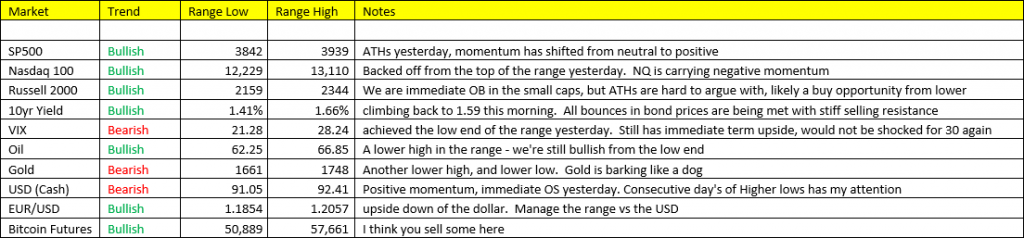

The US Dollar is capturing my attention here – we’ve seen consecutive day’s of higher lows in our range, and it’s momentum signal has shifted to positive. If we’re embarking on shift in macro markets, the dollar is one of the first places you’ll begin to see it. 91.05 to 92.41 is our range to manage. If we’re seeing a shift/transition from weak to a firm(er) dollar, this will likely create lower highs in many commodities that we’ve going forward.

NASDAQ- its as clear as day the tech stocks are falling out favor…. the NQ -1.50% vs RTY UNCH and SPY -0.38%. The tech sector’s IVOL has been signaling a transition from multiple weeks of carrying premiums to now threatening a series of discounts. XLK -10% and QQQ -10% IVOL discounts. Big tech were the “pandemic/stay at home stocks” last year and are carrying some very difficult y/y comps for revenues and eps.

That’s all for now…

Good luck,