Good morning,

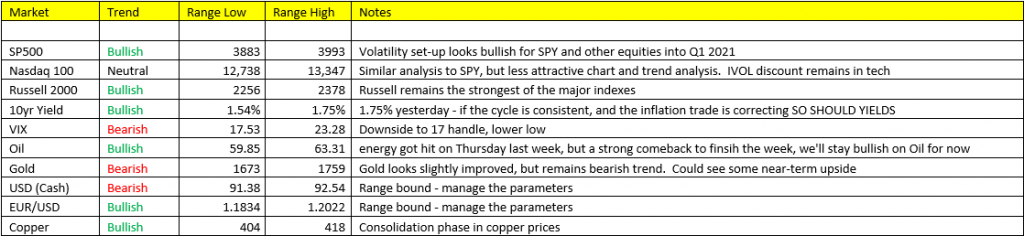

Coming off of a “correction” week in stocks, we’re seeing a modest bounce back this morning. That’s of course if you want to call -2.0% off of the all-time high a correction. The correction was led by Energy related stocks (Crude Oil -6.5% last week). SPY +0.16%, NQ +0.65%, and RTY UNCH headed into the open.

Bond yields are backing off their 1yr highs of 1.754% last week to 1.68% this morning – we mentioned that if there was any consistency in the inflation trade last week, we’d likely see a modest pull back in yields – which we’re seeing this morning. $28B of inflows from pension funds into bonds this week is what we’re hearing, the largest fund inflow into Fixed income since 2009, so if there were ever a time for a counter-trend bounce in bonds vs bond yields, it’s now.

Copper corrected -1.3% last week, +0.27% to start the week.

Volatility, the VIX following a bounce to 23.17 on Friday, has since back off this morning to 20.99 with immediate-term downside to 17.53. The Volatility set-up looks bullish for stocks here.

Headed into the end of Q1 2021, there’s reason to believe markets will hold it together and continue their upside bias over the next 2 weeks, especially in the event of a counter-trend bounce in bonds (downtick in yields).

We remain bullish on the reflation trade, and back off in bond yields could assist in this trade throughout the end of Q1 2021 next week.

Good Luck,