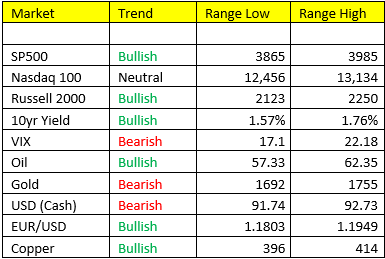

Massive Scenario 2 relief rally in equities yesterday – the SPY bounced right off of our immediate-term trade line of 3851 and low end of our range. The Russell and Nasdaq also went along for the ride higher. But, the undercurrents of the market are swirling. The Russell Index (small cap value stocks), now look the weakest of the major indexes. Value tends to lead on the way up, AND on the way down. So, if markets are in transition phase, the Russell Index may begin to underperform for a brief period of time (especially if we’re going to take a peek at Scenario 4 headed into Q3). I’m well aware of these macro changes, and usually need a little time and space to assess the environment AND we will get this right. But, I’m not going there yet, we remain in Scenario 2 – and these last few day’s may have been the last good opportunity to position for it.

This is how we think 2021 plays out in terms of the Growth and Inflation cycle are concerned:

Q1/Q2 – Scenario 2 (G accelerating, I accelerating) – this has been correct – Bullish just about ALL RISK ASSETS

Q3- Scenario 4 (G slowing, I slowing) – Risk Off/Underweight for equity markets and commodities, Overweight US Dollars and Treasuries

Q4- Scenario 3 (G slowing, I accelerating – STAGFLATION) – Overweight commodity assets, specifically Energy. Underweight equities. Overweight Treasuries

That’s our playbook in it’s simplest form.

Bond Yields– catch a bid overnight as stocks move back to “risk on”.

Copper- Bid right off of the low end of our range overnight. Immediate upside to 414, which yes IS A LOWER HIGH. Copper remains in a consolidation period, trade the range.

Precious Metals- they look very weak still. Gold and now silver as well. Silver traded below 24.85 early yesterday, before recovering. We can bounce from here, but risk remains tilted on the downside. Silver is the “Moby Dick” aka “the White Whale” trade. Everybody knows the potential in this market and wants to catch it…BUT I’ve seen many men go broke over the years not managing risk appropriately in this space. You don’t want to be like them, nor do I. Gold is a SHORT from the top of our range, and it’s a good possibility I hit the sell button if we get there.

US Dollar- Goes bullish trend IF we climb above 93.30. I remain bearish of the dollar until this happens.

NO MARKET INSIGHTS ON MONDAY AND TUESDAY. I’ll be in transition from the city to the suburbs this weekend and early next week. I should have my office up and running by mid-day Tuesday and fully plan on trading the afternoon session. Bear with me for a few days.