Markets crashed through the floor boards yesterday on the CPI “surprise”. It shouldn’t have been a surprise to ANYONE, especially not in this corner. CPI +0.8% vs +0.2% m/m and 4.2% vs 2.6% (MAR) y/y. Deep Scenario 2, Growth and Inflation accelerating. The market move yesterday is likely going to change the technical landscape of the market over the next 1-4 months –Scenario 4 remains the call IN Q3 2021. Technical analysts all over the Twittersphere are calling market tops and blah blah blah, and the bears are getting excited. It might be right, it might be wrong….what I do know is if we are going to Scenario 4 in Q3, there’s going to be plenty of trading opportunities along the way. Tops are a process and quantitatively speaking, all the indexes are immediate OS, BULLISH trend, and of course at the low end of the range. That’s how I’m viewing markets this morning, no panic, just process oriented. And yes, check out the IVOLs – it would appear to me, much of Wall Street was prepped for a day like yesterday via the implied vol option premiums being deeply positive.

UPDATE: PPI accelerated 6.2% vs 4.2% (Mar) y/y

Initial Claims fell to 473K vs 507K previous

Stock Index Profile:

IVOLs vs 30 Real. Vol. aka the cost to hedge

SPX 72% vs 45% w/w

NQ 49% vs 40% w/w

RTY 53% vs 17% w/w

Heavy premiums indicator interest to hedge via Puts, counter consensus signal favoring the longs.

CFTC Position:

SPX (19K)

NQ (16.5K)

RTY (23K) nearing the heaviest short position on a 1 yr look back

Markets have a funny way of pleasing the least amount of investors, aka the non-consensus view….

A few market comments a la carte:

Nat Gas- still has a positive tilt on the chart, and we remain bullish of energy. Increased US LNG exports remain a central bullish theme, but is it enough to propel us higher. Technical view favors more upside at the moment. We’re hold a long Nat Gas bias on the books with immediate upside to the top of the range 3.08.

Platinum- it’s been a market we’ve been bullish on for a while, not so much at the moment. The weekly view looks toppy and a breakdown could be imminent. The longer-term fundamentals (which I haven’t reviewed lately, but will update my notes this weekend) remain bullish. Platinum looks like a sell side trade from here going forward.

VIX- Massive reflex higher in the vol instruments. Immediate OB here, coupled with immediate OS in stocks. We may be attempting to break into a higher regime of vol, actually we absolutely think we are. But markets are likely to wade back and forth between either side of the range until a definitive trend appears. VIX Neutral trend in the model, with more downside than upside potential near-term.

10yr Yields: approaching the top of our range, you should be covering up short bond trades, for now.

Good luck,

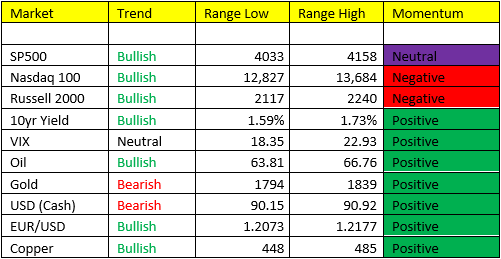

Some of you have noticed my speaking in terms of momentum lately. Last year around this time, I started to track this momentum indicator and having it paired with my market trend and range signal, I find it to be another credible/accurate tool when making a directional call. So I’ve decided to place it in the range table below for at least a little while.

DISCLAIMER:

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results.