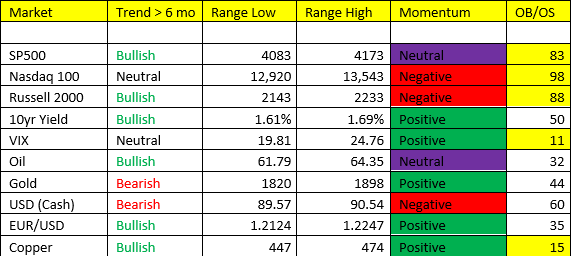

Stocks: A steady melt-up in the equity space yesterday right off the opening bell – the NASDAQ led the way +2.0%. US Initial Claims hit a pandemic low mark of 444K vs 474K in the prior week, and the some members of the Fed began to open up the “QE taper” discussion. Off the open all of the major indices are going to open up in immediate OB territory, with neutral and negative momentum. All of the >6 mos. trends, except for Nasdaq (Neutral trend) remain bullish. If markets continue to stretch, we may see another shift in momentum on Monday or Tuesday, but the probabilities suggest a pullback off the open – we’ll have to wait and see. IVOLs remain at a PREMIUM in stocks.

Energy/Oil: Energy including oil and natural gas signaled immediate OS at the close of business yesterday. The market told tales of US/Iran agreements, cease fires, and pipeline construction – all of which may be true, but the math said “Buy” yesterday. So we allocated a small position long in Crude and Natural Gas. I think that’s why some struggle with my decision making process – because most investors jump from headline to headline and chase the market action. The facts in the model suggested that oil was bullish trend, AT the low end of the range, bullish inside of Scenario 2, and immediate OS. That’s really what the call boiled down too.

BONDS/Yields: Bonds are going to open up immediate OB/Yields immediate OS. What’s the next catalyst for a jump in yields? Perhaps the US Non Farm Payrolls due out in 2 weeks. We had a big surprise miss in the headline number (missed by approx. 700K jobs), I’d expect differently this go around AND perhaps some sharp revisions. We remain bullish of US Employment from here. UP in Yields, could also translate into DOWN Gold as well. There’s a trade here I think.

We’ve got some PMI and Housing data due up here shortly.