Good Morning,

Yesterday’s action was interesting to say the least – following the ADP, Initial Claims, and the record ISM Non-MFG PMI data (64.0 vs 62.7 prior) markets fell into a mini-taper/inflation tantrum. Better employment data from here on out only feeds the idea that the worst of the inflation is yet to come, and with the Fed still running its QE at $120B/mo., you’ve got to believe a taper is being discussed inside the walls of the Federal Reserve. We’ve recently thought as early as July, but could they surprise with a June taper? Unlikely in my opinion. But, could a Fed taper spark a Scenario 4 market reaction coupled with slowing y/y Growth/Inflation data (as we expect) – it certainly could, and we’ve had July pegged as a pretty high probability period of risk in markets.

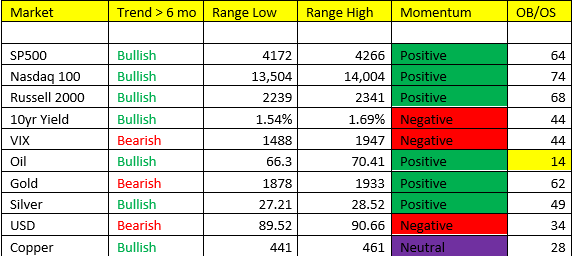

Oil- remains steadfast at 69.00 and looks to be on its way into the 70s. Bullish trend, positive momentum, closing in on the top of the range warrants a “sell some” but we remain bullish of oil prices from here.

Gold- a big wipe out yesterday on higher yields and a Fed taper possibly on deck – offered us an opportunity to look to reposition here. Gold could struggle as Scenario 4 looms in July, but ultimately we think gold will begin to perform much better out into the Fall and into year-end. We still like SILVER better quantitatively speaking, as silver is Bullish trend.

Yields- Bond yields traded up 3bps and have immediate upside to 1.69% in the 10yr. Yields like the idea of stronger employment and the possibility of a Fed taper on deck.

Non-Farm Payrolls are due up in about 15 minutes and so I’m going get going here. 650K expected, 5.9% rate, and keep an eye on wages and revisions from the May number.