Calm before the storm? Question I’m asking myself this morning as IVOLs sink into discounted levels. IVOL discounts (as you all know by now) are signals of complacency and lack of “hedging interest” for markets. Regardless, we’re having a difficult time seeing anything extreme in terms of downside in US Equities and Commodities, and if anything we’d welcome a correction as a buying opportunity headed deeper into the summer. The Fed put remains in place, and it looks like it will be there at “full capacity” for a few extra meetings than we originally surmised. Lo and behold, a taper is coming, but we largely believe markets will look through this. $120B tapered back to $100B – what are we really talking about here? I’m tired of talking about it to be quite honest.

Oil/Nat Gas- Correction in Oil this morning, -0.79% from yesterday’s high of $70.00. Flashing immediate OS with Positive momentum in our table below, but not quite at the low end of the range, yet. We ultimately believe higher prices are still likely to come in the back half of the year. Natural Gas looks more and more attractive as it holds bullish trend with positive momentum. We’ve successfully Nat Gas on the long side several time over the past few weeks.

Consumer Prices Index- The CPI data due on Thursday almost feels like a “tourist attraction” at this juncture as just about every lame TV commentator has an opinion on consumer prices. We say another “hot” reading is coming and probable, but the question is…is this the peak of the y/y CPI acceleration? It is quite possible, and probable we see “peak” CPI on Thursday and even a higher probability we’ve seen “peak” rate of change acceleration in that number. Regardless, we’ve seen a paradigm shift in inflation, and it’s likely to remain elevated for an extended period of time.

VIX- Continues to breakdown – driving risk assets higher. The low end of the range has broken the “15” handle this morning, as IVOLs sink modestly into the “red”. I absolutely pity the fool who’s getting squeezed on the short side of US Equities at the moment – and honestly, according to the CFTC Futs/Opts positioning table, there’s plenty out “shorts” out there!!

Good luck,

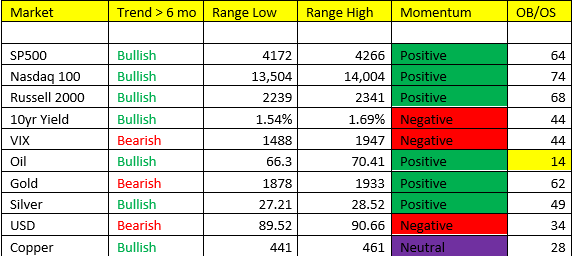

TRM Table:

*Nasdaq approaching immediate OB, not quite at the top of our range yet.