My takeaway from yesterday’s FOMC meeting is that Jay Powell may be just as confused about the definition of “transitory” as you and I may be. He maintained that high consumer prices are likely “transitory”, but warned the increase may ultimately be “higher and more persistent” than originally expected. So unless the word “transitory” has a double meaning, what he said (in the same sentence mind you) was higher prices are likely short-term, but may be longer term than they expect. He also said this is the “talking about talking about” a taper meeting. Got that?

So, it’s most likely that the taper discussion OFFICIALLY begins at the August Jackson Hole meeting (although it basically began yesterday).

*The Fed also see’s 2 rate hikes in 2023, and I should also mention that Powell said the “dot plot” didn’t matter and it’s not an accurate forecaster. So, more confusion around that as well.

Markets:

Stocks traded lower: SPX -0.8%, NQ -0.7%, and RTY -0.6%. Also note the series of lower lows and lower highs that have been made 3 to 4 sessions.

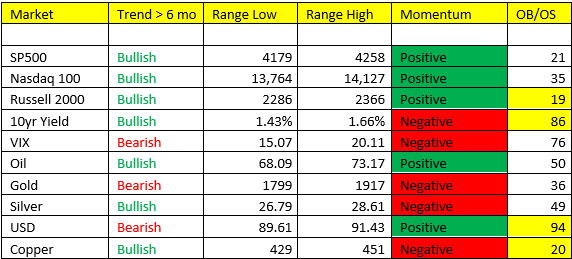

10yr yields rose 9bps yesterday, sending the 10yr Note prices tumbling. The bond market gave us a flattening yield curve look yesterday, shorter-term yields rose faster than longer-term yields, which only highlights the confusion around yesterday’s Fed lingo and where exactly we are in the economic cycle. A flattening of the curve is one that signals macroeconomic uncertainty and something potentially ominous. Notice in the table below the 10yr yield is carrying NEGATIVE Momentum and signaling immediate OB here, BUT the trend remains BULLISH – got that, plenty of confusion out there at the moment around direction of bond yields.

Metals If you’re a bull on metals (as I am in Silver) you know they’re not going to make it easy on you. Metals are getting tattooed this morning as yields rise, how long and persistent will the rise in yields be? I don’t know, what I do know is that we still have Scenario 4 as a probability in Q3 (July-Sept). Keep your positions small in metals for now. Gold remains below trend (Bearish) and Silver is pressing our trend line this morning and needs to fight to hold its Bullish trend. Going forward, we think it’s entirely possible that Gold and Silver become the “flight to safety” instrument in a Scenario 4 style market and IF Bond yields fall from here.

In case you haven’t noticed, multiple macro markets have pressed their respective “Bull/Bear” lines, essentially pushing investors/traders into a position of fight or flight. We saw in the US Dollar back in March and most recently, 10yr yields pressed our 1.42 bull/bear line, we fought and it held. This morning, it’s Silver and Copper.

These are shark infested waters we’re in, keep your positions small out there, obey the trend signals, and Good luck out there.