Good morning,

Reminder: It’s triple witching day with all the Jun Indices set to expire at the open today, so be mindful if you’re still in June Stocks.

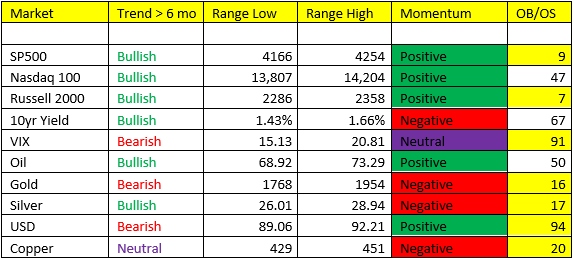

Yesterday’s post Fed action was interesting to say the least. We’re currently sitting on a big time immediate OB signal in the US Dollar following its ramp on J Powell’s “talking about talking about tapering” lingo. And with an OB USD, we’ve got a slew of immediate OS signals in the commodity space this morning.

Yields/Stocks: we got a lot of movement over the past 24hrs in bond yields (10-12bps) but coming into this morning, we’re sitting at 1.48% basically UNCH pre-FOMC meeting. I’m watching the 1.42% level for any signs a near-term Bond yield “breakdown” – but rest assured, bond yields are likely heading markedly higher over the course of the next 6-12months. Maybe the biggest stand out to me was the “flattening of the curve” post Fed where short-term yields rose faster than long-term yields – this is why our 30yr vs 10yr spread missed the mark, but our short 10yr out rights played well. A flattening yield curve usually portends something ominous from a macroeconomic standpoint – this is why it would not shock me to see an immediate-term break down in yields to be honest, followed by an equity correction in July/Aug time period. We’ve seen some commodity deleveraging over the past few sessions, equities may be next. However, I do still think there’s short-term long side trade potential in the near-term for stocks. Head on a swivel.

Energy- I’m on the watch for a pull-back here, we will be buyers of Crude Oil if we get that look. Crude -1.00% pre market hovering around 70 BBL. The inflation trade IS NOT OVER from our perspective, but we likely take a pause in Q3 – and I think we’ve made this abundantly clear from our “Shallow” Scenario 4 in Q3 calls.

Metals- We sent out the Silver buy yesterday, we did have a very small existing long position for the record. We like metals here, specifically IF we are going to see a minor “pause” in the inflation cycle, but inflation OR Stagflation rather, likely reignites again in Q4. If you’re having trouble following my outlook….its a minor slowdown in Q3 followed by a re-start of the REFLATION/INFLATION trade in Q4. Scenario 3 (STAGFLATION) in Q4 is the call – this is where Gold and Silver BULL markets live. We had the STAGFLATION Call on in Q3 of last year, and we saw some pretty materially gains in Gold and Silver during that time period. This doesn’t mean we can’t probe lower in the immediate-term but if Bond yields sniff out a slowdown and begin to back-up, this would make a very strong case for DOWN RATES = DOWN Dollar, UP Gold, UP Silver. With that said, we could eat some garbage in the near-term – stay small and watch what bond yields do from here.

Good luck,

Notable:

*A higher high in the Gold and Silver range is registering as the market squeezes traders that CHASED at the highs.

*A lot of “yellow” highlights below on immediate OB and OS signals.