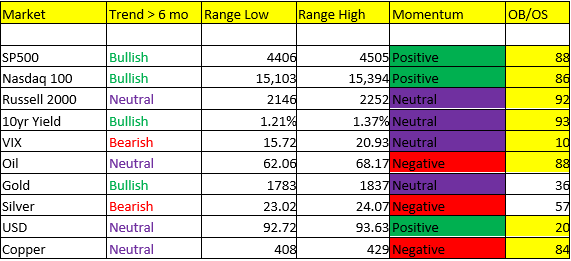

Ok, just when you thought it couldn’t get anymore interesting, it just did. I’ve got 8/10 markets signaling some extreme OB/OS headed into the Powell on Friday. I’ve got the Russell 2000 back to NEUTRAL trend, the 10yr yield back to BULLISH trend, and Oil close to BULLISH trend again (spending < week BEARISH). There’s speculation that we may hear a “DOVISH” Powell on Friday, and that could be in the midst of being priced in. Gold looks interesting here as well, with an expanding top end of the range to 1837 (A dovish Powell would be good for Gold). I didn’t issue the Russell signal to move to full position yesterday (despite holding a small short position now), because my signal changed above 2235 to neutral AND perhaps more importantly, the 10yr yield broke to BULLISH trend. Now, if POWELL goes dovish I’d expect large caps would be off to the races likely dragging small caps with them, but would likely be the laggards – dovish Powell would also push yields back down under trend. Why would Powell go dovish, well there’s plenty of reasons namely the Retail Sales, and the Consumer Confidence flops of last week, POLITICS (remember he’s up for reappointment this year), AND he doesn’t have to show his hand until after the August labor report next Friday. So this is the dance the market is doing, the “old Potomac 2 step” for Tom Clancy fans out there.

So, the question I’m trying to answer here is WILL WE SEE A CORRECTION IN THE MARKET THIS YEAR? I can’t definitively answer that, but what it would enable us to do is WAIT for another drop in bond yields to help us tighten our grip on a bond SHORT position into yearend as we look for a Scenario 2 set-up (this could change of course, but that’s the probable outcome at the moment). We’ve got seasonal weakness, we’ve got a likely soon-to-be HAWKISH Fed, and we’ve got some slowing growth data and questions around “PEAK” corporate earnings, and GDP – basically, it can’t get any better than right now.

If the Fed doesn’t signal taper, they risk falling further behind the curve, it they do accelerate the taper, well there’s going to be more consequences to suffer in the bond market. I don’t know what the outcome is going to be, so let’s dance.