Has our Scenario 4 call all been priced in?

After a 3 day sell off in stocks, is that all she wrote on our call of Scenario 4 in Q4? I don’t know to be quite honest with you and we’ll continue to monitor the day to day price action and confirming economic data releases. Over the weekend Speaker Pelosi gave the Trump administration 48hrs to pound out differences between both parties on a stimulus package. It looks like we’ll get a vote in the Senate over a “skinny” $300B aid package, but it’s highly unlikely to pass through the House Dems. We still are of the belief that stimulus is unlikely ahead of the election. Also, Johns Hopkins University is now estimating Covid-19 cases at over 40 million worldwide!

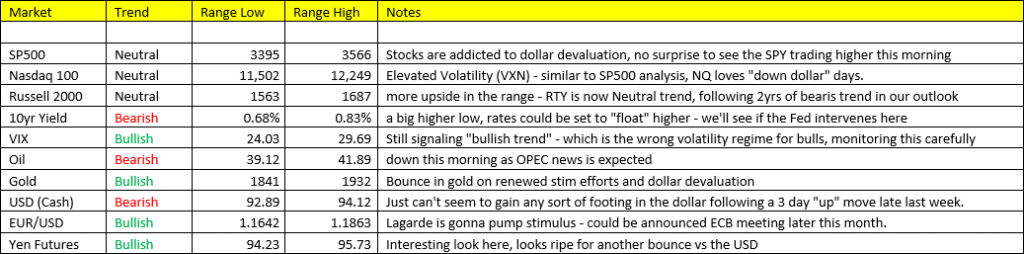

US Dollar- the glue that’s been holding it all together and what our Scenario 4 call together, aside from the data, is married too. The Dollar is back down this morning, following a 2-3 day bounce, following renewed stimulus efforts. Down dollar, risk assets Up. Our call was for another bout of Scenario 4, growth/inflation slowing renewed bounce in the US Dollar, following our bear market call in the greenback from June. This clearly has not panned out as the market goes from Scen. 4 back to Scen. 3 this morning. The remains our only outstanding long position in our ***Trade Signals.

Stocks- the NASDAQ has sweated off its consensus “bearish” position from last week, so let the “bubbly” games begin all over again. The implied volatility discounts in the Nasdaq of -12% has now moved back to a PREMIUM – or in other words a complacency signal. That’s a key signal, alongside the VXN (Vol index) to watch carefully. In terms of the election, I get asked this question a lot – In the event of a “blue wave”, I’d expect stocks to struggle into year end with the outlook of tighter regulation and higher capital gains taxes to take effect for 2021. This may prompt investors to book gains in big Tech into year-end, to avoid a tax increase the following year in the event of a Biden win in November. This is a very real probability. NASDAQ upside in our range goes all the way back up to 12,249 this morning.

Gold/Silver- +0.64% and +2.34% respectively this morning on stimulus talks and “down dollar”. Momentum indicators are still “bearish”, which could mute the gains in both metals out into November. While it’s nice to see both trading higher, we still think Gold/Silver could struggle into year-end (like many other risk assets).

I’m playing catch-up a little bit this morning, having been out since of the office late last week, so we’ll get back with you after the opening bell.