US Equities took a nose dive yesterday with the SPY and Nasdaq shaving off 2.8% and 3.0% respectively. Commodity prices also got whacked with Oil -4.0%, and down another 5.0% this morning.

More….

Soybeans -1.7%,

Copper 0.60%,

Gold -1.7%

Silver -4.3%

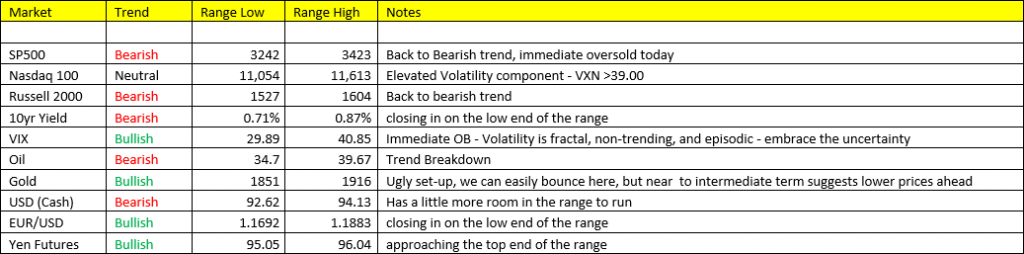

You get the picture. More downside follow through overnight, placing just about every asset class in immediate oversold territory. Clearly risk off yesterday, and more to come at the opening bell today. Scenario 4 day yesterday, and more today. Our probability remains at Scenario 3 at approx. 52% probability – it’s a tightrope.

Data: Jobless claims fell to 751K vs 770K estimate and Q3 GDP jumped 33%. The GDP data was better than expected, but it’s a backwards looking number, and still below pre pandemic levels y/y. Big Tech earnings after the bell today – why they’re all reporting on the same day is ludicrous in my opinion. MSFT reported and beat expectations on Tuesday, and still sold off. Clearly investors are nervous headed into today’s events, and perhaps booking gains in FAANG in preparation for a higher cap gains tax in 2021??

Gold: News that Central Banks were net sellers of Gold in Q3 was not taken too kindly. Gold’s set-up is fairly gruesome, and supportive of more downside in coming weeks ahead. We didn’t pull the trigger on Gold yesterday, many of you asked – the break below 1875 in our eye’s is an important message the market is sending us. A break of 1850 could take us down to as low as 1776.

Oil: Covid-19 has sparked renewed demand worries in energy. OPEC likely to extend production cuts, and next weeks election results (if we get them in a timely fashion) will also be very important for Oil prices.

There’s 2 ways to look at this tape, opportunistically or fearful – Embrace the uncertainty. We’re going to trade this. Stay tuned.