The USD has finally found some resistance, back down -0.16% this morning, while risk assets roll-up.

Metals: Copper +0.60%, Platinum joining in +1.41%, Gold and Silver +0.92% and +1.99% respectively. Copper specifically looks to be on a solid path to 3.30 as US inflation (and Chinese growth) continues to accelerate.

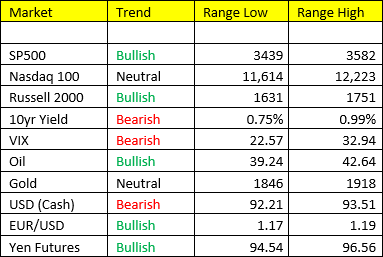

10yr yields back -10bps day/day. We’ve removed Bonds from our basket of long ideas, and will likely make its way onto the “Sell” list. Inflation will (and already is) be accounted for and expressed via rising rates at the long end of the curve. Don’t be surprised to see a “Sell 10yr Notes” trade pop up in your email soon.

Oil- pulling back, be ready here. We still may take a peak under 40 – but I may not wait. Sometimes its OK to be early, so long as you have the trend in your corner. We’re not going to “nail” every top and bottom, that’s just not realistic. We’ll keep our positions small, and trade with the overall trend, which moved to bullish again earlier this week.

Producer Price Index PPI accelerated y/y from 0.4 to 0.5 – Inflation accelerating

If you haven’t already learned by now, the economy is NOT the market and visa versa. Unfortunately for most of this country, they don’t have the wherewithal to purchase risk assets (or short the USD) that help them offset the burden of rising inflation costs. For most of America, they punch their time clock in the morning, and punch out at the end of the day. And while it’s nice to get a stimulus check in the mail or extra unemployment benefits every week, don’t for a second think that that doesn’t come with a price. Inflation. This has been ongoing since June, following the crash in March, and this is likely to persist through the first half of next year according to our forecast.