Some bullet points this AM….

-More vaccine news overnight, Pfizer raising effective rate to 95%. Great, now let’s get this show on the road.

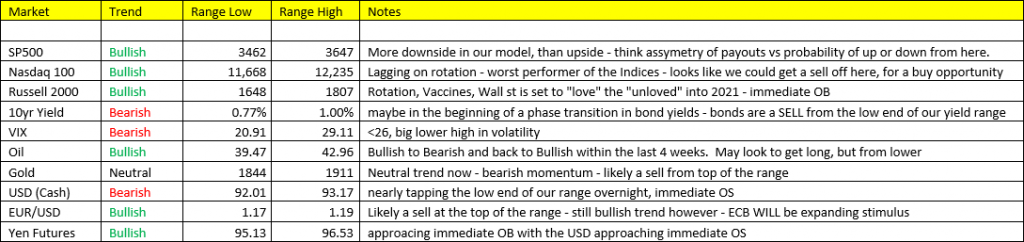

-10yr yields falling back 2bps overnight, closing in on the low end of our range….77bps – Bonds are a SELL in Scenario 2…..Growth/Inflation Accel

-Gold continues to weaken as the USD approaches OS levels. Don’t be alarmed if we short Gold from higher. Platinum and Silver look to be in better shape than Gold here.

-Bitcoin: Immediate OB here with downside to 14,898 – currently trading at 17880 off the overnight highs of 18540.

-Nasdaq looks to be the weakest of the Index’, with the Russell 2000 clearly the strongest

I need to address this about Gold….many of you are of the belief that Gold is the end all be all of inflation hedges, and it’s partially correct, but partially not. And the “partially not” part could save you a lot of money in your long side Gold bias.

Gold LOVES Stagflation, that’s Growth slowing/Inflation accelerating. Why? Because the USD is a SHORT, and Bonds are LONG (Yields a SHORT). As the US Fed attempts to light a fire under growth via easy monetary policy (low rates) and stimulus (dollar devaluation), they do so by attempting to create inflation. This is the best case scenario for Gold. What Gold does not take too kindly too is Growth AND Inflation both accelerating simultaneously. Why? Because the USD tends to rise during this phase alongside interest rates! When we enter a more friendly growth and inflation environment, Wall st tends to pull forward inflation expectations in the form of a steeper yield curve (long term rates rising faster than short term rates)…..Gold does not like this scenario…..up dollar, up rates – Not a good combo for Gold prices. This is why we’re not a big fan of Gold AT THE MOMENT. We’ve been Gold bulls for 2yrs now, hopefully we’ve established some credibility on Gold with you by now. Any question on this are welcome.

As promised….some notes on PL

Platinum:

330,000 supply side deficit

Coming into the week PL was -8% ytd as opposed the outsized gains in Gold, Silver, Copper etc

Gold: PL ratio historically carries a premium to the PL side….currently >2.00 to Gold – this ratio has been out of synch since the VW emissions scandal of 2015

PL is 30X more rare than Gold and 15% more expensive to mine.

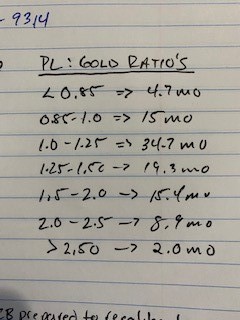

PL to Gold Ratio sample sets from my notebook:

We’re presently north of 2.00 if we see mean reversion back to the most common sets we’re looking at 1.50 or approximately a $468 price increase in PL, and that’s assuming Gold at roughly 1800 an oz.

Green Hydrogen Technology:

Gaining momentum in Saudi Arabia and Europe

GER has made its largest allocation to Green Hydro from its Green Energy Fund

Hydro has yet to gain the acceptance of America, but this likely changes under a Biden administration

PL plays an integral role as a catalyst in the electrolysis process of breaking down water into hydrogen and oxygen

100 miles south of Salt Lake City, UT there’s a big dig happening, that may potentially become the world’s largest green energy reservoir in the world.

The article below, is where you can read more about the pros AND cons of Green Hyrdorgen Technology

-the cons are questions around cost effectiveness compared to fossil fuels

-infrastructure and transportation of the fuel via pipelines

-safety, hydro is combustible, and tends to embrittle metal if small pipeline leaks occur.

You can read more about this here: https://www.bbc.com/future/article/20201112-the-green-hydrogen-revolution-in-renewable-energy