A considerably much more quiet morning than yesterday. Looking at the board right now, more signs of inflation are jumping out at me….

Copper +2.06% (Immediate OB) to 328

Platinum prices +1.48%, to 965

Oil +0.52%, to 42.00

Gasoline +1.14% to 1.1783

Soybeans +1.34% to 1193

Corn +1.01% to 427

Bitcoin +1.30% to 18330

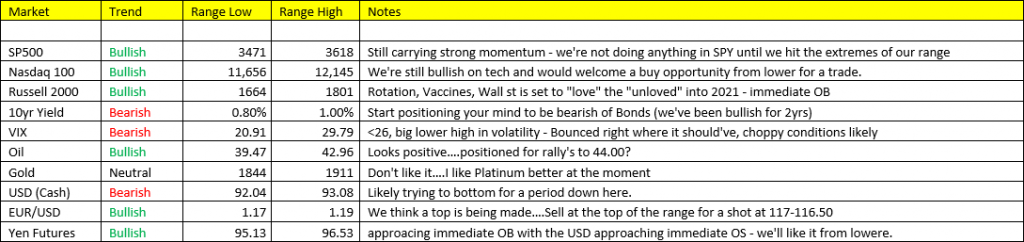

All of the above are signal OB this morning, but this is Wall Street positioning for Growth/Inflation Accelerating out into next year. The question is now, when do I begin positioning for a steeper yield curve aka lower bond prices? I’m slowly making that turn, and plan on moving to full position when the 10yr yields hit 80bps – But there’s always a chance I go earlier too! Maybe today. We’re close this morning at 83bps on the 10yr yield.

We have a nice bounce in Nat Gas to cover on this morning…back soon.