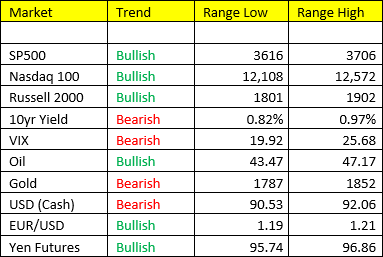

Running back last week, it was a great week to be long of inflation related assets. Particularly Oil +1.6% (+17% m/m), Copper +3.1% (+15% m/m), and Platinum +2.9% taking its monthly gains to +10.4%. Markets seem to be cooling off this morning, and from my estimation, perhaps entering a period of 1-2 weeks of risk…..before perhaps more of the same reflationary ramp into year-end.

- USD- decided to come of some “air” early this morning, climbing back to 91.23 but has since retreated. The dollar has room to bounce here, but likely won’t get too far. Stimulus talks seem to be restarting, and wouldn’t shock me to see something develop into year-end. But for the dog and pony show of partisan “hard ball” in Washington DC continues. But, we think not only is the cycle responsible for the recent accelerated slide in the USD, but also news of Janet Yellen’s being appointed to Treasury Secretary. Janet has long been a proponent of low interest rates, and has a long track record of being considered a “dove”. The US Dollar los 1.00% of its value last week…bringing its ytd decline to the tune of -6.2%.

- Energy- we’ll be watching for entry points to get involved in the energy rally. If we are on the brink of about 1.5-2 weeks-worth of market risk, we think we’ll get our chance.

- Treasury Yields- yields are rising, and we think into year-end to early 2021 they’re going to begin rising faster. It wasn’t long ago the 10yr yield was carrying a range low of 0.50% – while there’s always a chance to retest out into the future, we don’t think we’re going back to those pandemic lows in yields anytime soon. Hunting for opportunities to add to our short positions in Bonds.

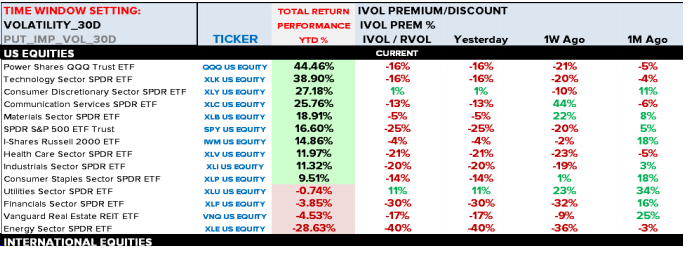

Implied Vol table…..SPY showing -25% IV discount, NQs -16%, RTY -4% – The SPY and QQQs showing complacency here, we’d warrant some caution for the bulls here, BUT we remain bullish on US equities now and going forward.

Let’s keep our eyes on this coffee market as well…..coffee is just as much a bullish play on EM currencies as it is on the commodity itself.