I’ll save you the dissertation this morning, as there’s not too much to discuss that we already haven’t hit upon. The one thing I will say is watch-out for more Covid-19 market “jitters” in the near-term. News of the virus is starting to getting louder and louder as the day’s go by despite the news of the Pfizer vaccine, I’ll leave it right there…..

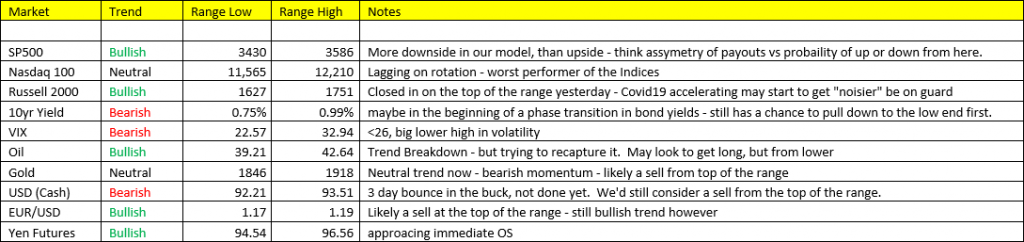

Treasury Yields: yields are backing off from the top of our range for 99bps. Despite the bounce in bonds (down in yields), market conditions are changing from the standpoint of the cycle. There’s a clear rotation happening in markets, more money flows to small caps and away from large caps as institutional funds start to look at the “bigger picture” and begin positioning for a Growth/Inflation accelerating environment in 1H2021. On that note, as mentioned above, the spike in Covid-19 cases in the US and Europe recently, we still think there’s a rising probability of another volatility event on the horizon. Be on guard, and perhaps bond traders are preparing for this with the move back down in yields (up in Bonds). Pivoting one more time here, we do believe the low in bond yields is in – and perhaps out into year-end we’ll be pivoting away from our 2yr bull market call in bonds – and eventually becoming bond BEARS. Got that? So in simpler terms, I think we’ll see a bounce in bonds to position short.

USD: We’ve got a 2-3 day bounce happening here – perhaps chasing the higher yields and expecting more competition in the currency war from global central banks. I’m expecting a wider trading range to be established in the Dollar, and in the intermediate-term, I think we’ve established a low. Well out into next year, we think that the dollar has a strong likelihood of resuming its decline, but we’re not even going to begin going there just yet.

Gold: with rising yields, and a multi-day bounce in the USD, it’s of no surprise to see Gold underperforming. Gold, in our opinion is NOT done moving lower over the intermediate term. With our forecast of a higher yields to come in 2021, you must know the correlation….Up Yields + Up Dollar = Down Gold. Gold is not a commodity in our model….IT IS A CURRENCY! I may begin shorting Gold to be honest with you, if you don’t like that, well sorry I’m not sorry. Gold is a short/underweight in Scenario 2 aka G/I accelerating – which is where we’re going in 1H2021.