“There are plenty of obstacles in your way. Don’t let yourself become one of them” – Ralph Marston

I have to often remind myself of this….

This game is hard, and it’s supposed to be…..But the good news is, anybody can play it…and play it successfully if you remember 2 things A. Your feelings are usually WRONG, and B. the 2 most consequential factors that drive asset class returns are Growth and Inflation -Ray Dalio. Over my 17yr career, I’ve seen some of the smartest people in the world lose money, and A LOT of it, playing this game…from Neurosurgeons, Aerospace Engineers, even Nobel Prize Winner’s….in ECONOMICS!!! I sh#t you not…why is this? Well for one thing, perfection is UNATTAINABLE. These markets don’t follow any set of rules, there are very few “properties of law” they follow, in other words, these markets are non-linear and at times often unpredictable! You cannot WIN at this game by simply studying out of a text book or simply holding an advanced degree. From years spent around the Chicago Board of Trade, some of the most successful traders I’ve met were “street” type guys. Traders that could adapt to different environments, were humble enough to know that they were NOT the smartest guys in the room (check out “When Genius Failed”), and arrogant enough that they could let a poor trading day blow by like a stiff Chicago breeze in January. Oh and also weren’t as staunchly focused on the day to day narratives and noise….and when I say noise, I really mean the NEWS. Newsflash…the news is often slanted towards the BAD!

Trading education is a lifelong endeavor, so long as you’re involved in these markets you should continue to study your craft and continue to work towards the unattainable….perfection. Note that you’ll never achieve it, but if you chase it long enough….success will often follow.

Let’s run it back…

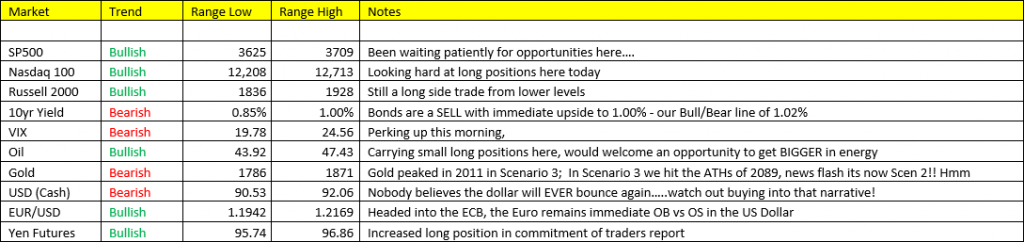

Stocks: SPY lost 0.9% yesterday, NQ -2.4%, and RTY -0.7% …. That’s right we traded down yesterday, a rare event nowadays…..I’m sure there was some news involved, but I’m not really that concerned about it. Stocks traded down, because the math suggested they were OB. IV premiums were trading at a discount for more than 2 weeks….usually a sign of complacency. Now what? Do we have the cojones to get long(er) in the markets that outperform in Scenario 2? We’re going to open immediate-term oversold today at the open in the NQs.

Yields: immediate upside in the 10yr yield to 1.00%, currently sitting a .93%. We remain bearish of Bond prices/bullish of yields for the foreseeable future. Get involved.

Gold: Oh I know your “feelings” were getting in the way on Monday/Tuesday when Gold shot higher to 1879….did you’re feeling prevent you from “selling” more up there with us? I’m sorry if they did. Gold is not a “long” side trade in Scenario 2….especially while it’s carrying a “Bearish” trend. Platinum and Coper are better long side trades…why? They’re Bullish trend for one, and another thing, they’re more USEFUL commodities from an economic standpoint.